Morning Dispatch Morning Dispatch |

Insurers vs Aggregators

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Morning Dispatch

We'll soon meet in your inbox.

India’s banks have always had the upper hand on fintech firms, thanks to strict central bank regulations, and relations between the two have thus always been frosty at best. This hasn’t been the case in the product-led insurance sector, where many older companies have partnered with new-age startups. But that seems to be changing, too.

Also in this letter:

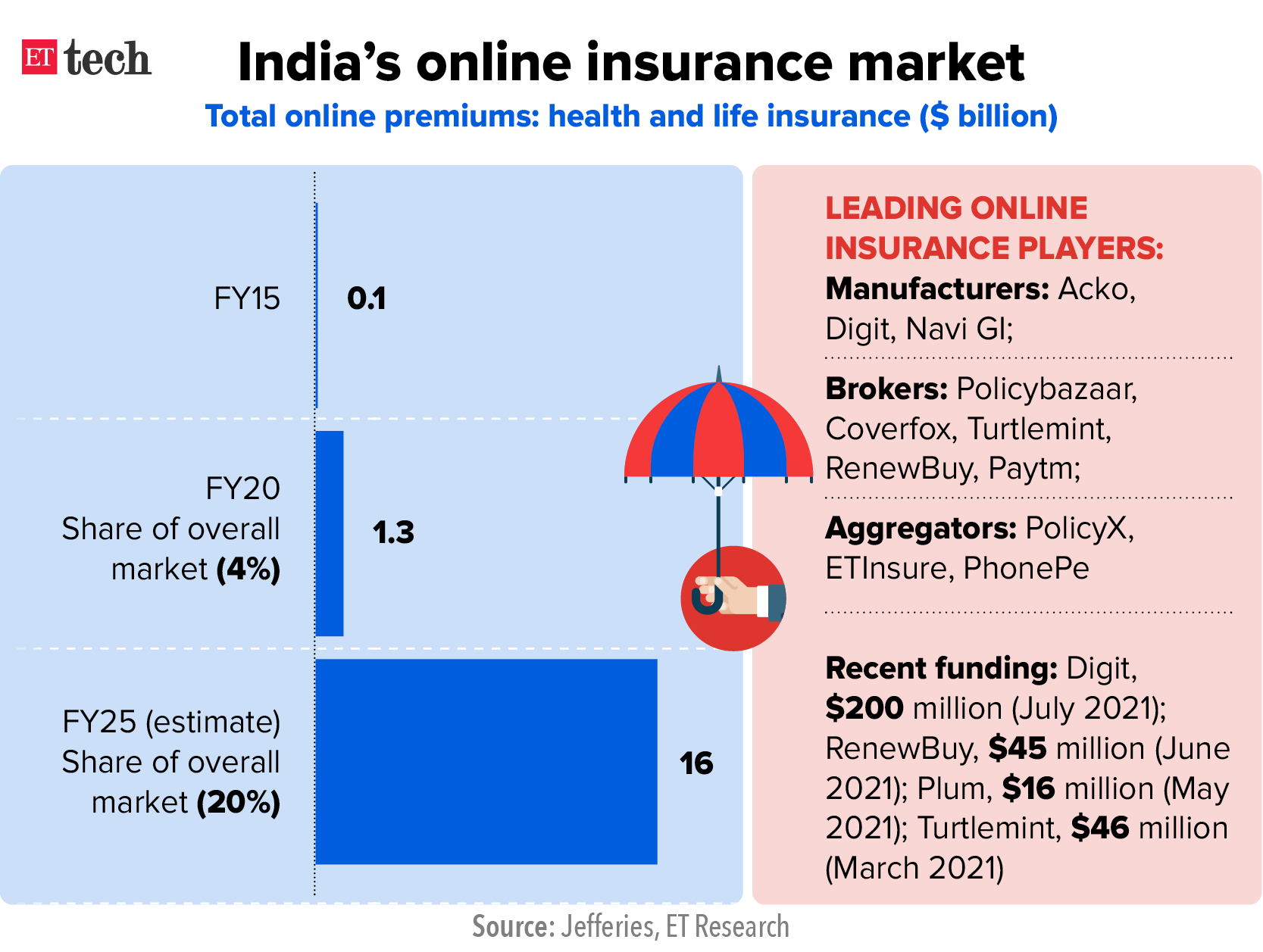

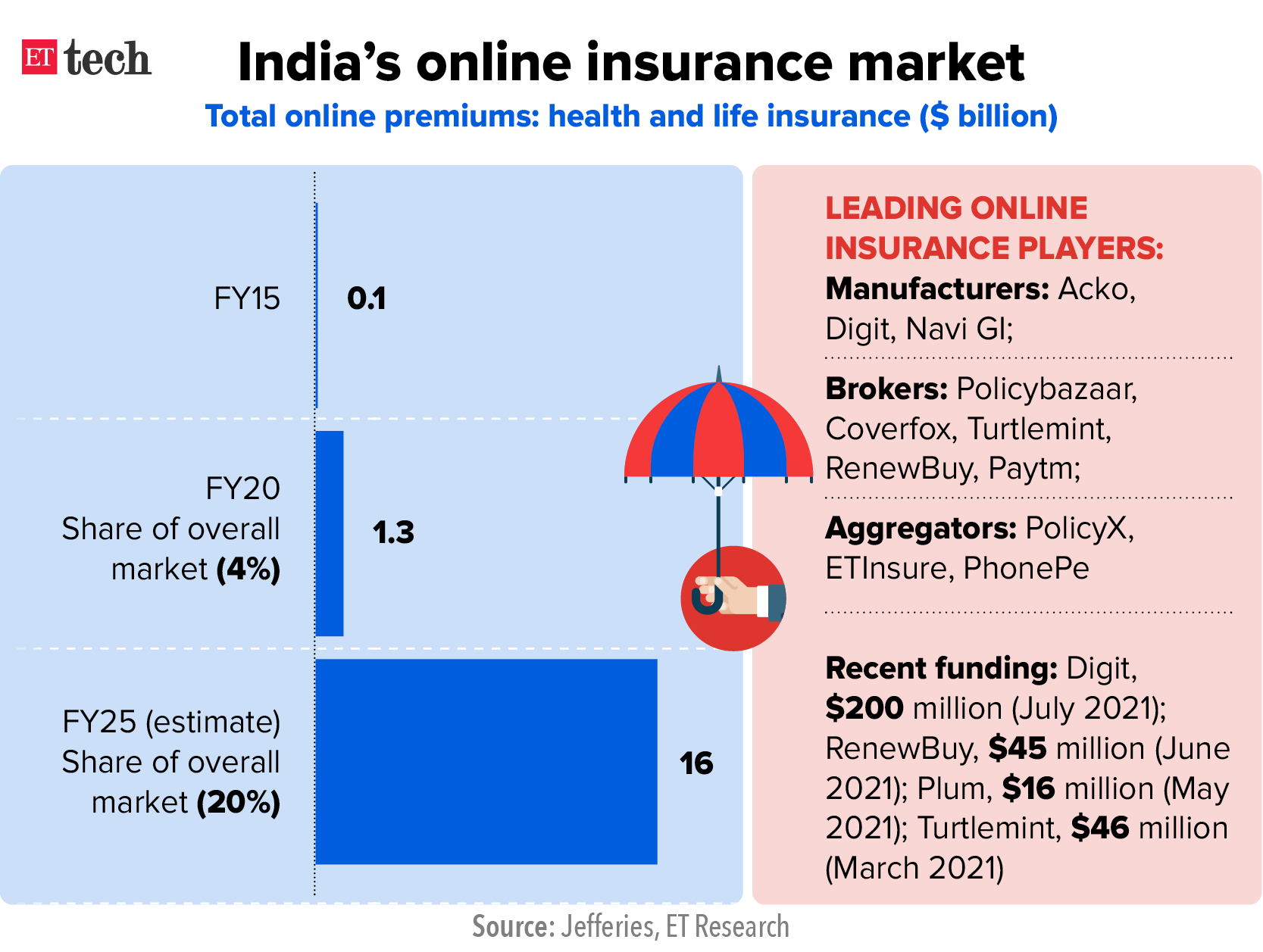

Hi, it’s Ashwin. Insurtech companies in India have been among the most active in attracting risk capital, just as they are around the world. Startups like Digit, Acko, Plum and RenewBuy have been busy in the private market, and the sector has already produced three unicorns. The leading company in this space, Policybazaar, is set for a landmark initial public offering, seeking to raise more than Rs 6,000 crore.

In 2020, the growing sector attracted deals worth over $7.5 billion globally, according to a BCG report, making it one of the fastest growing sub-sectors in fintech. This momentum is expected to increase significantly in 2021. We wrote about this in the June 29 edition of this newsletter.

For decades, insurance companies sold most of their policies either through networks of on-ground agents or through banks. But with the entry of the likes of Policybazaar in the 2010s, that business model was upended forever.

According to a Jefferies report, 0.1% of life and health insurance policies were sold online in FY15. This rose to 4% in FY20, and the US investment bank predicts it will increase to 20% by FY25.

Legacy insurance companies are clearly in unfamiliar territory, where they no longer own the sales channels, and can’t dictate commissions to incentivise sales.

This new reality seems to be stirring a growing discontent among legacy players.

Earlier this year, HDFC Ergo quietly delisted its products from leading aggregators, including Policybazaar and Coverfox. In withdrawing its health and motor insurance products, it joined a small yet growing band of incumbents in India’s legacy insurance industry—which include the largest private sector general insurer ICICI Lombard and public-sector behemoth Life Insurance Corporation of India—that have either partially or completely shunned third-party online marketplaces.

Those following India’s fintech sector would be aware of challenges startups face as a regulatory upper hand allows legacy banks to dictate the rules in business tie-ups.

From IDFC First Bank Ltd. reportedly severing ties with fintech startups in recent months, according to a report by The Morning Context, to Kotak Mahindra Bank halting UPI tie-ups with startups in 2020, ownership and pricing concerns have soured relations between banks and fintech firms.

While the rise of insurtech in India has seen a more cordial approach by incumbents and disruptors, this could be set for a change.

Online distributors face several challenges to their business models:

Top insurers building their own digital capabilities:

This is interesting as India’s insurance distribution landscape has also seen large fintech and e-commerce companies such as Amazon, Flipkart, Paytm and PhonePe enter the space in the past couple of years.

Unlike banking, insurance is a product-oriented business. Therefore, platforms that operate within the regulatory purview and draw traffic have the upper hand, unlike in fintech, where the Reserve Bank of India has defined the scope for many new areas of operations. The evolving dynamic between insurance companies and their new-age counterparts is something we will see playing out in the coming years.

Read the full story here.

Unacademy cofounder Gaurav Munjal

Unacademy cofounder Gaurav Munjal

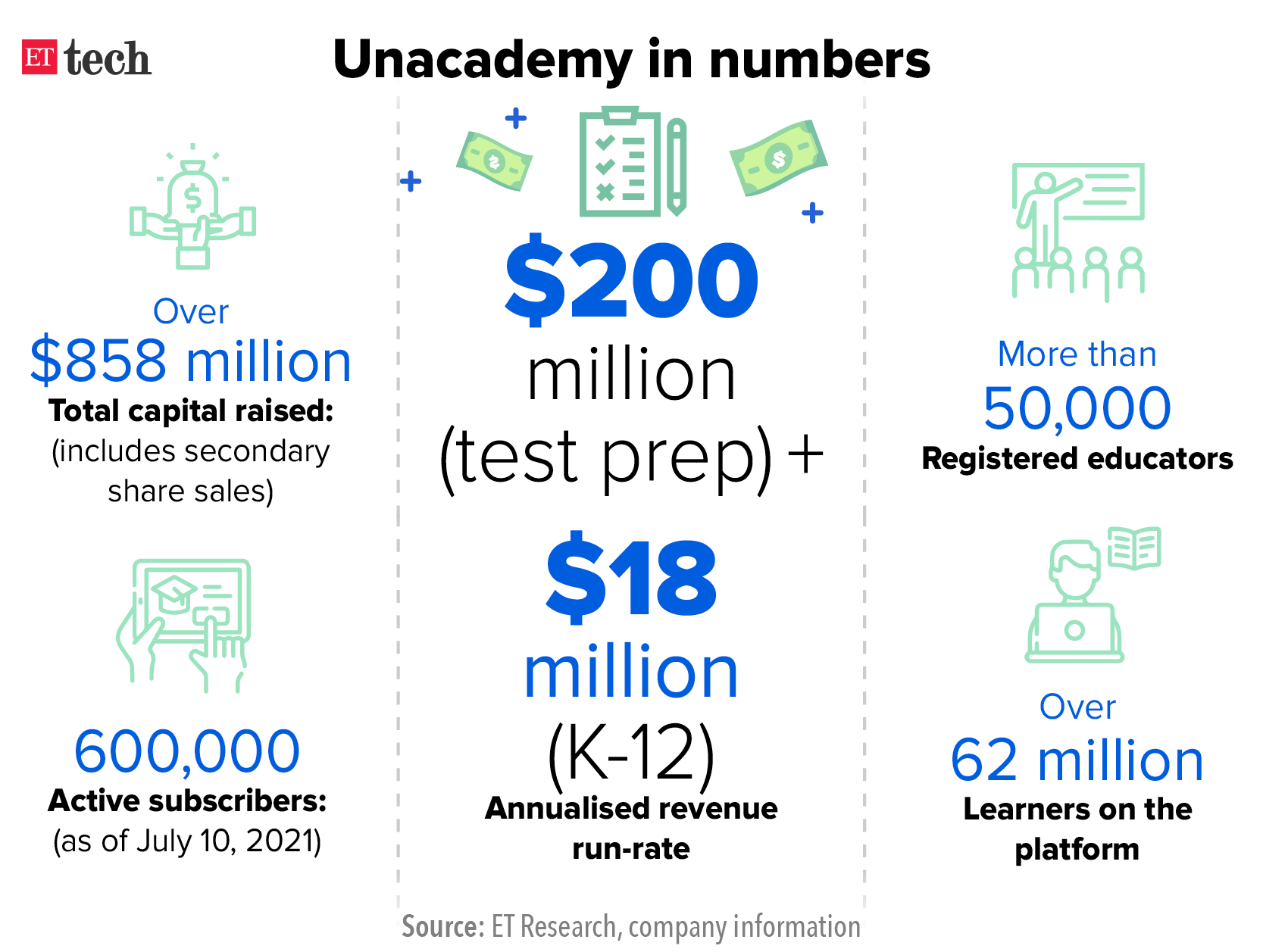

Unacademy has raised $440 million in a funding round led by Singapore’s Temasek, valuing the edtech startup at $3.4 billion, according to a top executive. South Korea’s Mirae Asset also joined the funding round. Existing investors such as SoftBank Vision Fund, General Atlantic and Tiger Global also cut big cheques.

Details: While the transaction will largely include a primary infusion of funds, the startup is facilitating a secondary share sale of $20 million to provide exits to one of its early investors as well as a slew of angel investors. With this, the startup will have conducted secondary share sales worth $70-80 million in the past year.

Unacademy, which was valued at $2 billion less than a year ago, has seen this jump 70% in the current round.

The edtech firm has also brought on board Aroa Ventures, Oyo Hotels & Homes founder Ritesh Agarwal’s family office, as well as Deepinder Goyal, cofounder and CEO of Zomato.

Looking beyond education: In an exclusive interview, Gaurav Munjal, cofounder of Unacademy, said the six-year-old startup, which began as a YouTube channel, “wants to position itself as a broader technology firm with multiple consumer-facing products and not be restricted to edtech”.

The company is presently clocking a $200 million run rate for its largest business — test preparation—while in K12, it has an $18 million annualised run rate. Revenue run rate is a projection of upcoming revenue based on previously earned revenue.

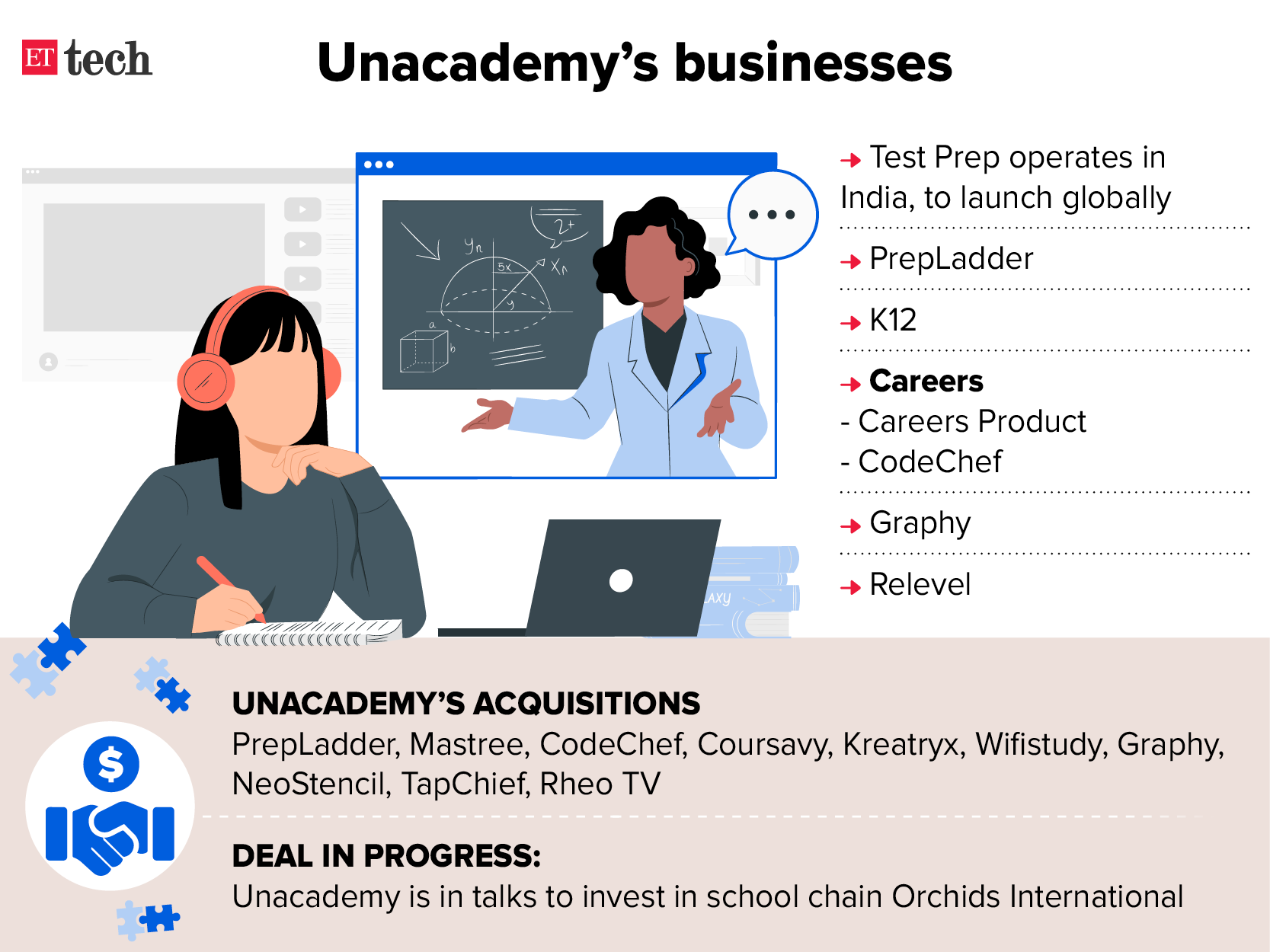

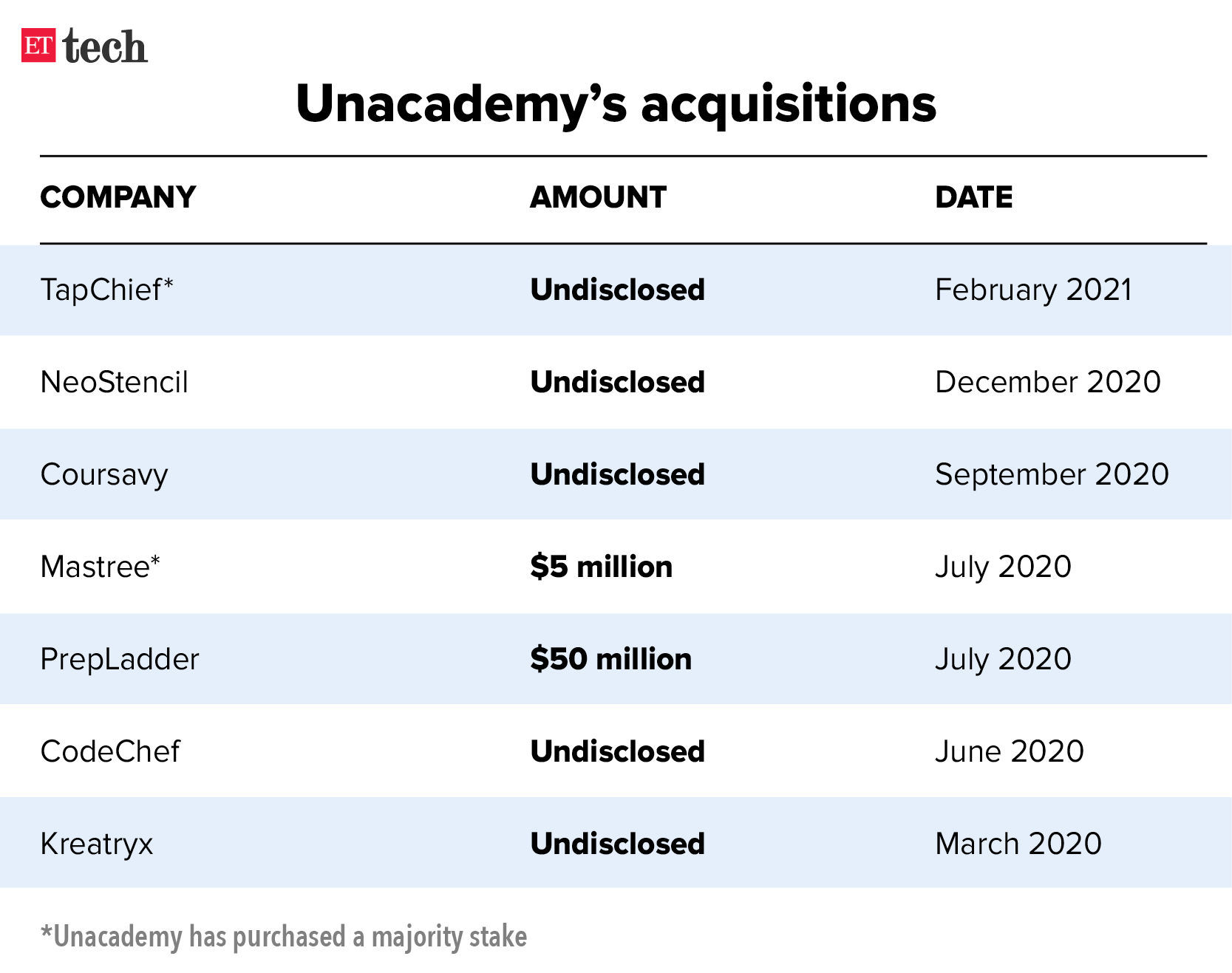

Acquisitions: Unacademy has made a slew of small to mid-sized acquisitions to boost new segments like jobs and the creator economy.

We reported last week that the company is in talks to invest in school chain Orchids, which would be the first such purchase by an edtech firm.

Munjal said these acquisitions and investments are a part of the company’s strategy to add scale to each of its verticals and achieve an annualised revenue of $100 million for them individually. Once these attain a certain scale, Unacademy will explore further diversification, he said.

IPO plans: The company’s plan for a public listing“now seems like a real possibility (after Zomato’s listing),” Munjal said. “Our core business is not high-burn, we’ll become profitable in the next 12 months and while there is no formal timeline yet, the company will seriously consider the option in the next two-three years.”

IndiaTech, an industry association that represents startup founders and investors, has suggested to the markets regulator that the net-worth requirement for shareholders with superior voting rights should be determined individually and not as part of the promoter group.

Last month, the Securities and Exchange Board of India (Sebi) proposed to ease rules governing the issue of shares with superior voting rights (SR shares) and sought feedback on it. The move was aimed at addressing legacy issues for startup founders looking to list their companies and potentially help them retain control even after they diluted their stakes.

The founders’ and investors’ concerns emerge from the fact that family members of SR shareholders may also hold a stake in the company, and such investments, under the rules, would be included while computing the collective net worth of the SR shareholder.

Other reccos: In its recommendations to Sebi, IndiaTech has also said that the net-worth threshold should be retained at Rs 500 crore.

Rameesh Kailasam, CEO of IndiaTech, told us the rule that requires the promoter to have a minimum stake of 20% after the company is listed also needs to be looked at.

Typically, most Indian startup founders own less than 10% of the company by the time they are ready for an IPO, having diluted their holdings to raise money from investors.

IndiaTech has recommended that the regulator should consider bringing this down to 5%, or even require promoters with less than 20% post-IPO capital to lock in their shares for a year.

Another key issue regarding SR shares is the sunset clause, which deals with how long SR share rights will be valid after an IPO. IndiaTech has said that there should ideally be no limit on such rights, but if that isn’t possible, they should be valid for 15-20 years.

Easing IPOs: Sebi’s proposals were triggered by feedback from industry stakeholders at a time when a growing number of startups are launching IPOs. Zomato has already listed on the bourses, while Paytm, Delhivery, Nykaa, Policybazaar and Mobikwik are at various stages of launching their public offerings.

Sebi is also looking at doing away with timelines for founders to issue SR shares before an IPO. Currently, founders are required to issue SR shares six months before going public. Sebi had said it received feedback that this requirement was onerous.

Who’s in IndiaTech? IndiaTech's founding members are Ola, MakeMyTrip and Steadview Capital. On its governing board are MakeMyTrip founder Deep Kalra, Steadview Capital's managing director Ravi Mehta and Kailasam. PolicyBazaar, Nykaa, Mobile Premier League, Dream11, CoinSwitch Kuber and CoinDCX are among its members, as is fund Falcon Edge Capital.

Zomato Ltd. has rolled out a new incentive for its riders amid questions on whether its bumper initial public offering has benefited delivery partners.

The incentive: The firm will allow delivery partners to keep the cash collected from cash-on-delivery orders for their own spending, and will adjust these against their weekly payouts.

“This saves delivery partners cash-in-hand. There is no payback required,” a spokesperson for Zomato said, adding that the credit incentive is not a consequence of the bumper listing.

“The credit limit benefit has been in the pipeline for a while. It was among the feedback we received from our delivery partners in their weekly happiness survey,” she said.

Win-win? According to experts, while riders will benefit, Zomato stands to gain as well.

“Riders benefit, but only to an extent, as they are at the end of the day only getting what is due to them, maybe a few days sooner,” said Harminder Sahni, MD at Wazir Advisors.

“The benefits for the company are that they don't have to handle cash at their end,” Sahni said. “So, a lot of processes, such as collecting [cash] from riders, accounting, and then depositing it, goes away, which will save the company resources.”

Zomato has more than 200,000 riders. While their salaries were increased in February, it was in sync with an increase in fuel prices.

India's social media landscape is spawning influencers at a fast clip, and scams, spam and other types of fraud are not far behind.

A recent study by an influencer marketing workflow and analytics firm says that more than 40% of Indian influencers on Instagram have been involved in fraud in one way or another.

Insta-fraud can take the form of buying fake followers, likes and comments, some of which are made by bots. (read more)

In the past few years, industries across the world have become increasingly aware about sustainability measures as well as environmental, social and corporate Governance (ESG) criteria. This has thrown up fresh opportunities for the Indian IT sector.

The rise of the mid-size: Second-tier Indian IT companies are steadily increasing the work they are doing for their top clients, building on the goodwill to sell more services to them. Mphasis and Mindtree are among those successfully mining their top accounts.

MoEngage’s fundraising: The insights-led customer engagement platform has raised $32.5 million (Rs 241.7 crore) in a funding round led by Multiples Alternate Asset Management.The capital will support and accelerate its global growth strategy and strengthen its artificial intelligence and predictive capabilities.

The cost of a data breach: A new study by IBM Security found that a single data breach costs a company $4.24 million on average—the highest in the seventeen-year history of the report. In India, the average cost of a data breach was Rs 16.5 crore in 2021, an increase of nearly 18% from 2020.

■ The pandemic effect is slowing (TechCrunch)

■ Zoom settles consumer claims over privacy for $85 Million (Bloomberg)

■ K-Pop's fandom platforms are changing what it means to be an idol (The Verge)

Today's ETtech Morning Dispatch was curated by Tushar Deep Singh and Zaheer Merchant in Mumbai. Graphics by Rahul Awasthi.

Also in this letter:

- Unacademy valued at $3.4 billion in latest round

- IndiaTech asks Sebi to tweak rules on SR shares

- Zomato rolls out new incentive for delivery partners

As insurance buying shifts online, legacy firms prepare for a fight

Hi, it’s Ashwin. Insurtech companies in India have been among the most active in attracting risk capital, just as they are around the world. Startups like Digit, Acko, Plum and RenewBuy have been busy in the private market, and the sector has already produced three unicorns. The leading company in this space, Policybazaar, is set for a landmark initial public offering, seeking to raise more than Rs 6,000 crore.

In 2020, the growing sector attracted deals worth over $7.5 billion globally, according to a BCG report, making it one of the fastest growing sub-sectors in fintech. This momentum is expected to increase significantly in 2021. We wrote about this in the June 29 edition of this newsletter.

For decades, insurance companies sold most of their policies either through networks of on-ground agents or through banks. But with the entry of the likes of Policybazaar in the 2010s, that business model was upended forever.

According to a Jefferies report, 0.1% of life and health insurance policies were sold online in FY15. This rose to 4% in FY20, and the US investment bank predicts it will increase to 20% by FY25.

Legacy insurance companies are clearly in unfamiliar territory, where they no longer own the sales channels, and can’t dictate commissions to incentivise sales.

This new reality seems to be stirring a growing discontent among legacy players.

Earlier this year, HDFC Ergo quietly delisted its products from leading aggregators, including Policybazaar and Coverfox. In withdrawing its health and motor insurance products, it joined a small yet growing band of incumbents in India’s legacy insurance industry—which include the largest private sector general insurer ICICI Lombard and public-sector behemoth Life Insurance Corporation of India—that have either partially or completely shunned third-party online marketplaces.

Those following India’s fintech sector would be aware of challenges startups face as a regulatory upper hand allows legacy banks to dictate the rules in business tie-ups.

From IDFC First Bank Ltd. reportedly severing ties with fintech startups in recent months, according to a report by The Morning Context, to Kotak Mahindra Bank halting UPI tie-ups with startups in 2020, ownership and pricing concerns have soured relations between banks and fintech firms.

While the rise of insurtech in India has seen a more cordial approach by incumbents and disruptors, this could be set for a change.

Online distributors face several challenges to their business models:

- Large insurance brands are reluctant to be pit against smaller rivals

- Incumbents invest heavily on digital, agent channels

- Insurers want price-based comparison model to “evolve”

- Quality advantage of online customers is fading with increasing traction

- Insurance companies are unable to control the customer experience

Top insurers building their own digital capabilities:

- ICICI Lombard — IL Take Care platform — retail health, cross-sell policies

- HDFC Life's 24X7 digital offerings and bots across 26 functions

- Max Life has launched AI accelerator programme

- SBI Life DIY digital platform along with cross-sale on YONO platform

- ICICI Prudential has launched ‘virtual handshake’ and digitisation across segments.

This is interesting as India’s insurance distribution landscape has also seen large fintech and e-commerce companies such as Amazon, Flipkart, Paytm and PhonePe enter the space in the past couple of years.

Unlike banking, insurance is a product-oriented business. Therefore, platforms that operate within the regulatory purview and draw traffic have the upper hand, unlike in fintech, where the Reserve Bank of India has defined the scope for many new areas of operations. The evolving dynamic between insurance companies and their new-age counterparts is something we will see playing out in the coming years.

Read the full story here.

Unacademy’s valuation jumps 70% to $3.4 billion

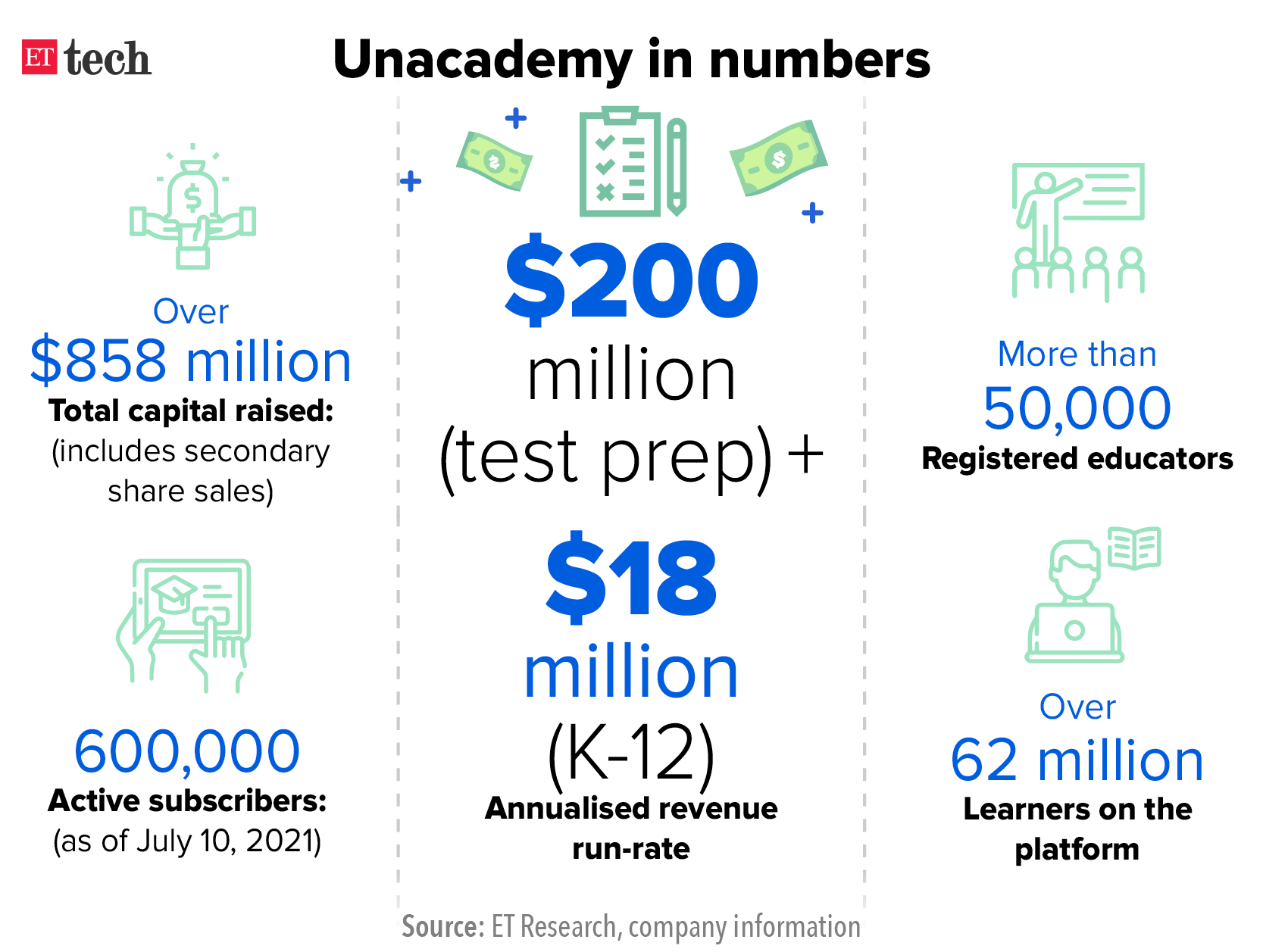

Unacademy has raised $440 million in a funding round led by Singapore’s Temasek, valuing the edtech startup at $3.4 billion, according to a top executive. South Korea’s Mirae Asset also joined the funding round. Existing investors such as SoftBank Vision Fund, General Atlantic and Tiger Global also cut big cheques.

Details: While the transaction will largely include a primary infusion of funds, the startup is facilitating a secondary share sale of $20 million to provide exits to one of its early investors as well as a slew of angel investors. With this, the startup will have conducted secondary share sales worth $70-80 million in the past year.

Unacademy, which was valued at $2 billion less than a year ago, has seen this jump 70% in the current round.

The edtech firm has also brought on board Aroa Ventures, Oyo Hotels & Homes founder Ritesh Agarwal’s family office, as well as Deepinder Goyal, cofounder and CEO of Zomato.

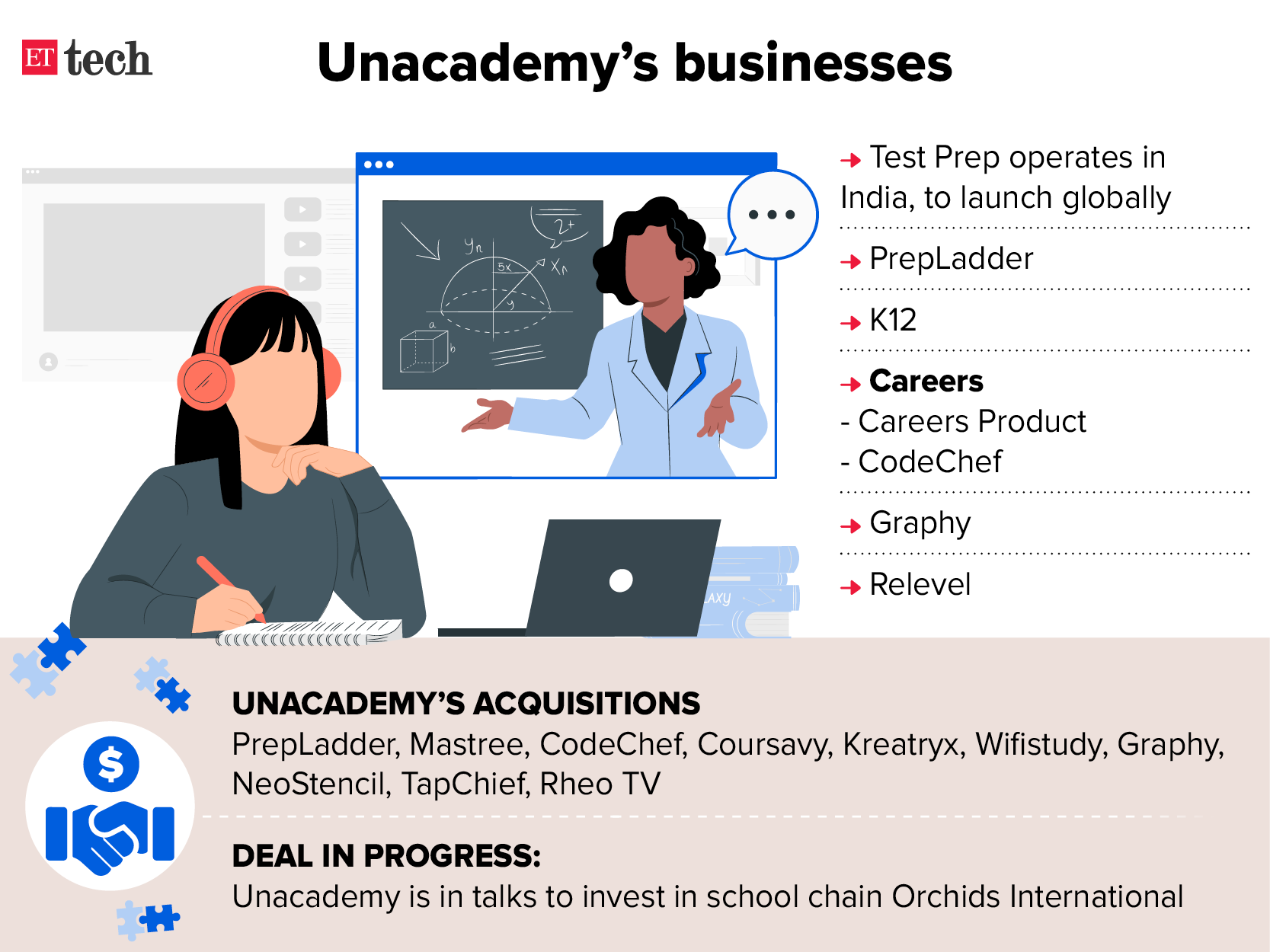

Looking beyond education: In an exclusive interview, Gaurav Munjal, cofounder of Unacademy, said the six-year-old startup, which began as a YouTube channel, “wants to position itself as a broader technology firm with multiple consumer-facing products and not be restricted to edtech”.

- Munjal plans to use the fresh funds to build new businesses in areas such as jobs and hiring, where it will compete with the likes of Naukri.com and Linkedin.

- It will also launch creator-led short courses and scale existing businesses such as test preparation and K-12 coaching.

The company is presently clocking a $200 million run rate for its largest business — test preparation—while in K12, it has an $18 million annualised run rate. Revenue run rate is a projection of upcoming revenue based on previously earned revenue.

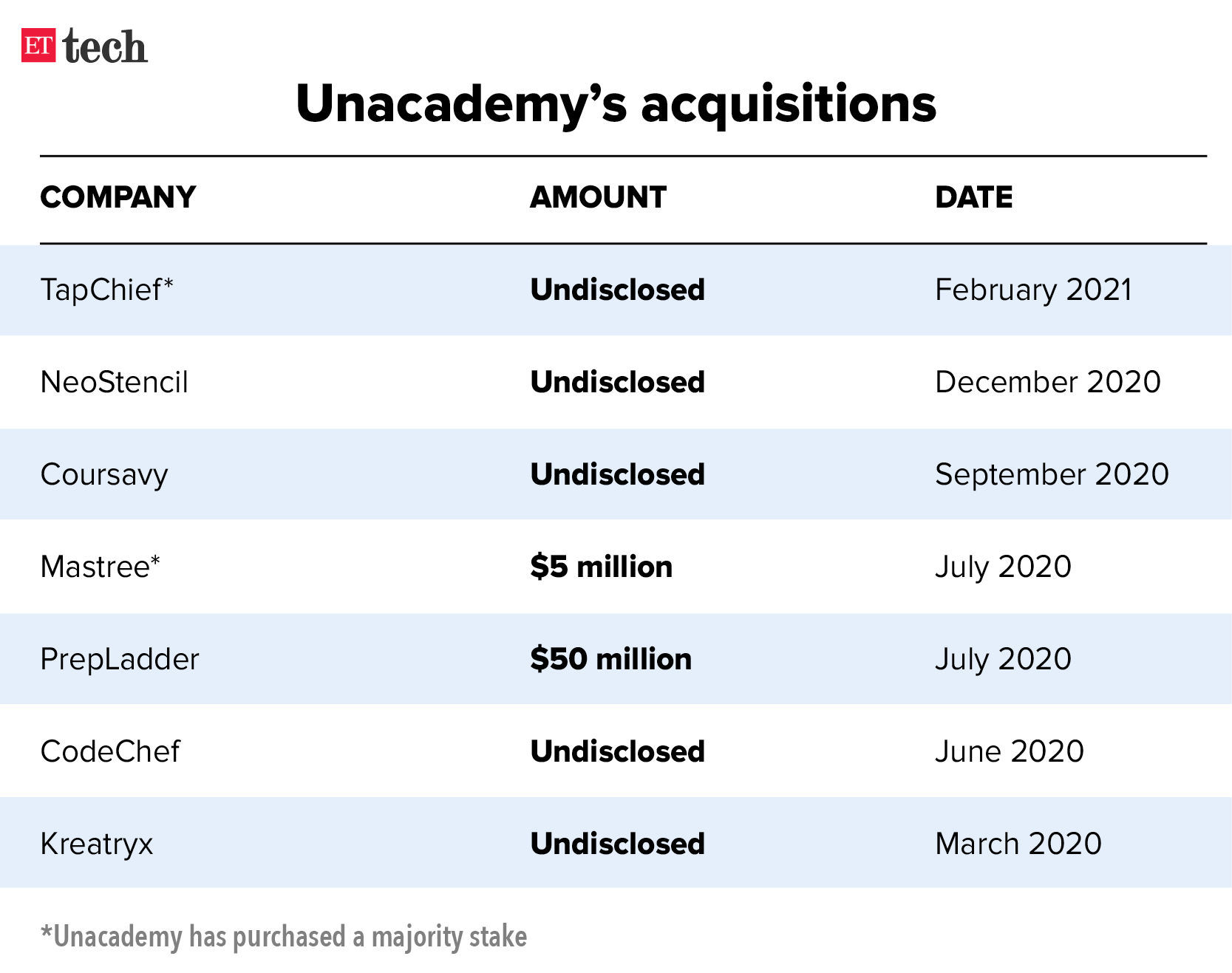

Acquisitions: Unacademy has made a slew of small to mid-sized acquisitions to boost new segments like jobs and the creator economy.

We reported last week that the company is in talks to invest in school chain Orchids, which would be the first such purchase by an edtech firm.

Munjal said these acquisitions and investments are a part of the company’s strategy to add scale to each of its verticals and achieve an annualised revenue of $100 million for them individually. Once these attain a certain scale, Unacademy will explore further diversification, he said.

IPO plans: The company’s plan for a public listing“now seems like a real possibility (after Zomato’s listing),” Munjal said. “Our core business is not high-burn, we’ll become profitable in the next 12 months and while there is no formal timeline yet, the company will seriously consider the option in the next two-three years.”

Tweet of the day

Founders, investors ask Sebi to tweak rules on SR shares

IndiaTech, an industry association that represents startup founders and investors, has suggested to the markets regulator that the net-worth requirement for shareholders with superior voting rights should be determined individually and not as part of the promoter group.

Last month, the Securities and Exchange Board of India (Sebi) proposed to ease rules governing the issue of shares with superior voting rights (SR shares) and sought feedback on it. The move was aimed at addressing legacy issues for startup founders looking to list their companies and potentially help them retain control even after they diluted their stakes.

The founders’ and investors’ concerns emerge from the fact that family members of SR shareholders may also hold a stake in the company, and such investments, under the rules, would be included while computing the collective net worth of the SR shareholder.

Other reccos: In its recommendations to Sebi, IndiaTech has also said that the net-worth threshold should be retained at Rs 500 crore.

Rameesh Kailasam, CEO of IndiaTech, told us the rule that requires the promoter to have a minimum stake of 20% after the company is listed also needs to be looked at.

Typically, most Indian startup founders own less than 10% of the company by the time they are ready for an IPO, having diluted their holdings to raise money from investors.

IndiaTech has recommended that the regulator should consider bringing this down to 5%, or even require promoters with less than 20% post-IPO capital to lock in their shares for a year.

Another key issue regarding SR shares is the sunset clause, which deals with how long SR share rights will be valid after an IPO. IndiaTech has said that there should ideally be no limit on such rights, but if that isn’t possible, they should be valid for 15-20 years.

Easing IPOs: Sebi’s proposals were triggered by feedback from industry stakeholders at a time when a growing number of startups are launching IPOs. Zomato has already listed on the bourses, while Paytm, Delhivery, Nykaa, Policybazaar and Mobikwik are at various stages of launching their public offerings.

Sebi is also looking at doing away with timelines for founders to issue SR shares before an IPO. Currently, founders are required to issue SR shares six months before going public. Sebi had said it received feedback that this requirement was onerous.

Who’s in IndiaTech? IndiaTech's founding members are Ola, MakeMyTrip and Steadview Capital. On its governing board are MakeMyTrip founder Deep Kalra, Steadview Capital's managing director Ravi Mehta and Kailasam. PolicyBazaar, Nykaa, Mobile Premier League, Dream11, CoinSwitch Kuber and CoinDCX are among its members, as is fund Falcon Edge Capital.

Zomato rolls out credit incentive for delivery partners

Zomato Ltd. has rolled out a new incentive for its riders amid questions on whether its bumper initial public offering has benefited delivery partners.

The incentive: The firm will allow delivery partners to keep the cash collected from cash-on-delivery orders for their own spending, and will adjust these against their weekly payouts.

“This saves delivery partners cash-in-hand. There is no payback required,” a spokesperson for Zomato said, adding that the credit incentive is not a consequence of the bumper listing.

“The credit limit benefit has been in the pipeline for a while. It was among the feedback we received from our delivery partners in their weekly happiness survey,” she said.

Win-win? According to experts, while riders will benefit, Zomato stands to gain as well.

“Riders benefit, but only to an extent, as they are at the end of the day only getting what is due to them, maybe a few days sooner,” said Harminder Sahni, MD at Wazir Advisors.

“The benefits for the company are that they don't have to handle cash at their end,” Sahni said. “So, a lot of processes, such as collecting [cash] from riders, accounting, and then depositing it, goes away, which will save the company resources.”

Zomato has more than 200,000 riders. While their salaries were increased in February, it was in sync with an increase in fuel prices.

Infographic Insight

How Indian influencers buy fake followers on Instagram

India's social media landscape is spawning influencers at a fast clip, and scams, spam and other types of fraud are not far behind.

A recent study by an influencer marketing workflow and analytics firm says that more than 40% of Indian influencers on Instagram have been involved in fraud in one way or another.

Insta-fraud can take the form of buying fake followers, likes and comments, some of which are made by bots. (read more)

IT services firms size up market opportunity for sustainable solutions

In the past few years, industries across the world have become increasingly aware about sustainability measures as well as environmental, social and corporate Governance (ESG) criteria. This has thrown up fresh opportunities for the Indian IT sector.

- The ESG market—estimated at about $50 billion by the end of the decade—could emerge as the next big growth driver for domestic software services providers.

Other Top Stories We Are Covering

The rise of the mid-size: Second-tier Indian IT companies are steadily increasing the work they are doing for their top clients, building on the goodwill to sell more services to them. Mphasis and Mindtree are among those successfully mining their top accounts.

MoEngage’s fundraising: The insights-led customer engagement platform has raised $32.5 million (Rs 241.7 crore) in a funding round led by Multiples Alternate Asset Management.The capital will support and accelerate its global growth strategy and strengthen its artificial intelligence and predictive capabilities.

The cost of a data breach: A new study by IBM Security found that a single data breach costs a company $4.24 million on average—the highest in the seventeen-year history of the report. In India, the average cost of a data breach was Rs 16.5 crore in 2021, an increase of nearly 18% from 2020.

Global Picks We Are Reading

■ The pandemic effect is slowing (TechCrunch)

■ Zoom settles consumer claims over privacy for $85 Million (Bloomberg)

■ K-Pop's fandom platforms are changing what it means to be an idol (The Verge)

Today's ETtech Morning Dispatch was curated by Tushar Deep Singh and Zaheer Merchant in Mumbai. Graphics by Rahul Awasthi.

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Morning Dispatch

We'll soon meet in your inbox.