Listing Migration: A Conflicted Path to Value Creation

SquareWell Partners (“SquareWell”) conducted an in-depth study of primary listing changes and the dismantling of dual-listed company (“DLC”) structures, examining precedents across global markets. This analysis separates cases driven by activist investors from those initiated by companies, highlighting unique motivations and outcomes in each. With activist-driven listing changes expected to become a central campaign theme in the coming year, this post focuses on activist-led precedents, offering strategic insights into this emerging trend. SquareWell concludes with key questions for the market to consider regarding the future of this development.

i. A New (Hot) Demand in Town

Activists generally did not engage in repeat campaigns, except for Cevian Capital, which led efforts at two companies, CRH and Pearson, to encourage the switch of their listings. In 2023, Cevian Capital explained that they “are looking at this everywhere”, asserting that these actions “will become the theme in the corporate restructuring market in the coming two to three years” (Source). Gatemore Capital Management supported this view, discussing that “Lobbying for re-listings of UK companies in the US is going to be an important part of the activist playbook […] we have been engaged with companies on this idea and many companies are open to it” (Source).

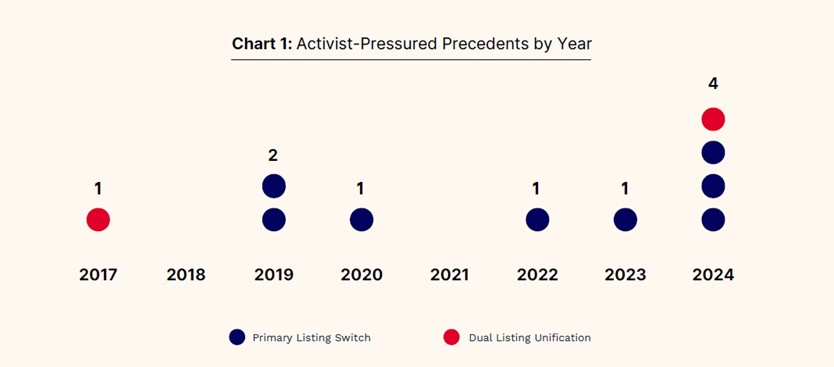

As shown in Chart 1, activists pushing publicly for a listing change peaked in 2024, however, it’s worth noting that many cases of investor pressure will occur behind closed doors. For instance, Third Point was reported to have encouraged several large, unnamed British companies to relocate from London to New York.

ii. Large Targets Across All Sectors (Excluding Materials)

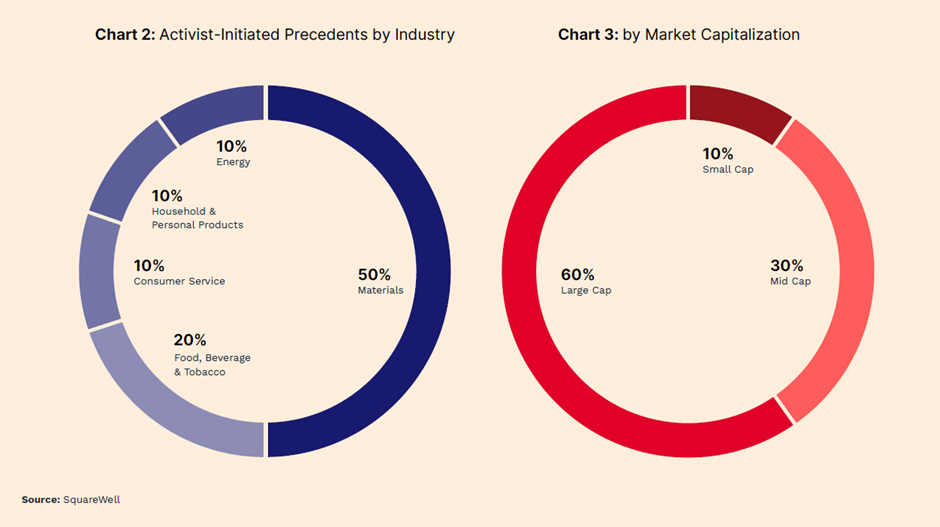

The most targeted industry (based on GICS) was ‘Materials’, which stems from the relative commonality of activists preferring a non-LSE primary listing for major mining companies (including Glencore Plc, Rio Tinto Plc, and BHP). In fact, the FT recently noted “that the market capitalisation of London-listed mining stocks has shrunk […] while rival bourses in Australia, Canada and the US have all overtaken it”, owing to the “higher valuations and deeper liquidity” and supportive “investor psyche” in these regions (Source).

Apart from the ‘Materials’ industry, activists were relatively sector-agnostic but showed a stronger preference for targeting large to mid-cap firms. This trend suggests that only companies with a substantial presence in the target listing country are likely to successfully undergo such restructuring—a challenge that smaller companies may find more difficult to achieve. Supporting this thought, activist Bluebell Capital Partners notes that the US market is very competitive and those without a large presence in the country risk being forgotten (Source) when seeking to change its listing to US.

iii. USA – The Land of Dreams?

Chart 4 shows the exchanges that the activist-initiated targets are listed on (denoted in red), against the exchanges that the companies were asked to switch to (denoted in blue). Activists targeted eight (8) companies to change listing from UK, while seven (7) companies were asked to list in the US; Australia was the second most desired destination owning to its attractiveness for major mining companies.

Activist interventions at companies are frequently sparked by poor corporate governance practices (including capital allocation) or by financial underperformance relative to peers. However, SquareWell observes that in the identified listing change cases, activists did not publicly criticize the companies’ governance practices or financial performance; on the contrary, many even praised them. For example, Butler Hall Capital cited that L’Occitane International S.A had “far superior growth potential” versus peers (Source), while Trian Fund Management noted that “Ferguson is a far superior business” compared to its peers (Source).

iv. Macro vs. Micro Activism – Dissatisfaction with the Market Rather Than the Company

This observation indicates that the activists’ frustration likely lies with the wider market’s inability or unwillingness to appreciate the company’s value proposition, essentially labelling the market as inefficient and creating “arbitrage opportunities”, as noted by Cevian Capital (Source). As this contrasts with the traditional activist agitations – pointing to a market failure rather than issues with the company itself – SquareWell labels it a clear juxtaposition of Macro vs. Micro Activism. Echoing this point was Sparta Capital Management that said “UK public markets are unwilling or unable to engage in Wood’s story” in its public letter to John Wood Group Plc (“John Wood Group”; Source).

In fact, activists and companies specify virtually no operational changes in their proposals. While activists have demands beyond switching the primary listing or unifying dual listings, these are typically presented as secondary options if their primary demand fails or are contingent on the success of their primary demand (such as pursuing equity-based M&A after the primary demand improves the share price). All of which further supports that the frustration lies with the market, rather than with the individual companies, marking a clear contrast from traditional, micro-level activism.

v. Key Reasons Presented for the Demand

Activists typically highlight three key rationales: (1) the potential for the target’s valuation multiples to rise, bringing them in line with industry peers, (2) the likelihood of increased trading volume (liquidity) for the target’s equity, driven by the larger pools of investable capital at the targeted exchange, and (3) better alignment of the listing venue with the target’s shareholder base or with its financial, operational, or workforce geographic focus, which may be more strongly represented at the selected location. For example, in the case of CRH, Berenberg had noted that “We believe that CRH is becoming an increasingly ‘American’ company as each year passes, albeit one with a proud Irish heritage […] we estimate that the Americas will account for 70% of profits this year, rising to 80% by 2025” (Source).

vi. Concluding Observations and Thoughts

All corporate transactions or restructurings carry inherent risks, and listing switches are no exception. While market attention often centres on the potential value gains of a listing switch, there are significant but often overlooked risks for institutional investors. These include:

- Conflict of Interests: With the US being the most frequent target destination for listing switch, which has high average CEO and Board of Director pay, decision-makers internally have a financial incentive to adopt shareholder demands or to advocate for the restructuring themselves, even if they believe it’s against the company’s long-term interest. A recent study by Schroders found that “in every US city considered, compensation packages [for CEOs] were found to be higher than in any UK city”, with the “package of the typical UK-based CEO [being] less than half the size of the average US-based CEO” (Source). Further exemplified through AstraZeneca Plc’s recent shareholder meeting, unless Europe changes its approach to remuneration, its capital markets may have to face the “remifications”.

- Diluted Shareholder Rights: The U.S. market is known for having less shareholder-friendly provisions, such as dual-class structures and staggered board elections, compared to the UK. Additionally, the regulatory burden for listings is lighter in the U.S. than in the UK—“over-regulation can deter companies from seeking listings on the London Stock Exchange” (Source). Consequently, stock exchanges are seeking ways to retain local listings, raising concerns about the potential compromise of shareholder protections. For instance, Italy’s new Capital Markets Bill and the UK’s FCA rule changes both favour founding shareholders by weakening key investor safeguards through dual-class share structures, multiple-voting rights, etc.

- Less Scrutiny on Environmental & Social Issues: Due to regional differences, as evidenced by major mining companies targeted by activists, companies in sectors under intense environmental and social scrutiny are incentivized to relocate their listings to more favourable geographic regions. “Europe, for example, has demonised fossil fuel producers to the detriment of a smooth transition to net zero emissions by 2050”, said Tribeca Investment Partners in its letter to Glencore Plc, a Metals & Mining company, in its campaign to switch its listing.

While understanding these risks is essential for prudent oversight, it also raises important questions: will the share price appreciation following a listing switch create a false sense of security, diverting companies from making necessary operational changes to ensure long-term value creation or address environmental and social risks?

An FT article titled “No, a US listing cannot fix every UK company’s problems” describes Sparta Capital Management’s campaign at John Wood Group as “delusional,” noting that “it is not clear why US investors would be any more inclined to buy shares until the company demonstrates it can generate sustainable positive free cash flow” (Source). Similarly, another FT article suggests that lower average earnings “largely explain why UK companies are valued lower than their US counterparts” (Source). Ultimately, investors have long held the belief that attractive valuations, regardless of where they are set, must be supported by strong fundamentals that inspire confidence in a company’s ability to generate long-term value.

Distribution channels: Education

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release