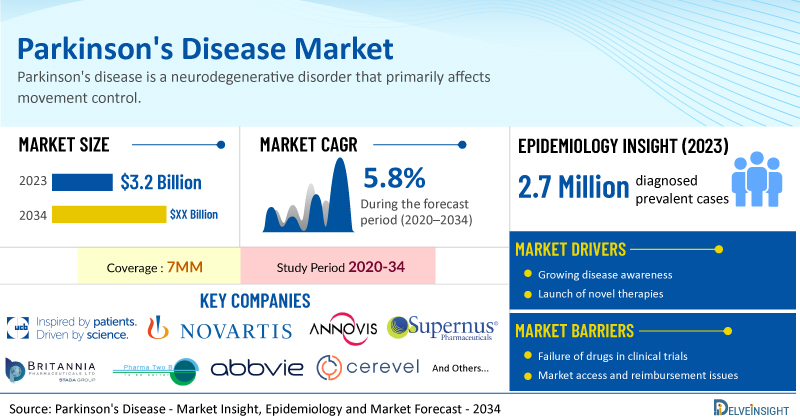

Parkinson's Disease Market is Expected to Showcase a Significant Growth at a CAGR of 5.8% During the Study Period (2020–2034) | DelveInsight

The Parkinson’s disease market is poised for steady growth in the coming years owing to advancements in diagnostic techniques, increased awareness of the condition, and a rising number of reported cases. Additionally, the current emerging pipeline is robust, late-stage drugs expected to enter the Parkinson’s disease market during the forecast period include Supernus Pharmaceuticals/Britannia Pharmaceuticals’ SPN-830, AbbVie’s tavapadon, and Pharma Two B’s P2B001, among others. The approval of these therapies could significantly impact Parkinson's disease market dynamics.

/EIN News/ -- New York, USA, Dec. 12, 2024 (GLOBE NEWSWIRE) -- Parkinson's Disease Market is Expected to Showcase a Significant Growth at a CAGR of 5.8% During the Study Period (2020–2034) | DelveInsight

The Parkinson’s disease market is poised for steady growth in the coming years owing to advancements in diagnostic techniques, increased awareness of the condition, and a rising number of reported cases. Additionally, the current emerging pipeline is robust, late-stage drugs expected to enter the Parkinson’s disease market during the forecast period include Supernus Pharmaceuticals/Britannia Pharmaceuticals’ SPN-830, AbbVie’s tavapadon, and Pharma Two B’s P2B001, among others. The approval of these therapies could significantly impact Parkinson's disease market dynamics

DelveInsight’s Parkinson's Disease Market Insights report includes a comprehensive understanding of current treatment practices, emerging Parkinson's disease drugs, market share of individual therapies, and current and forecasted Parkinson's disease market size from 2020 to 2034, segmented into 7MM [the United States, the EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan].

Key Takeaways from the Parkinson's Disease Market Report

- According to DelveInsight’s analysis, the market size of Parkinson's disease in the 7MM was USD 3.2 billion in 2023.

- According to DelveInsight’s analysis, among the currently approved therapies, the majority of the market share was of others and combination therapies, with a revenue of USD 2.2 million in 2023.

- According to DelveInsight’s estimates, in 2023, there were 2.7 million diagnosed prevalent cases of Parkinson’s disease in the 7MM. Of these, the United States accounted for 45% of the cases.

- Prominent companies working in the domain of Parkinson's disease, including UCB Biopharma SRL, Novartis, Annovis Bio, Supernus Pharmaceuticals, Inc., Britannia Pharmaceutical, Pharma Two B, Mitsubishi Tanabe Pharma (NeuroDerm), AbbVie, Cerevel Therapeutics, Cerevance, and others, are actively working on innovative Parkinson's disease drugs. These novel Parkinson's disease therapies are anticipated to enter the Parkinson's disease market in the forecast period and are expected to change the market.

- Some of the key Parkinson's disease treatments include Solengepras (CVN424), Minzasolmin (UCB0599), Buntanetap (ANVS401/Posiphen), SPN-830 (Apomorphine Infusion), P2B001 (Extended-release Pramipexole and Rasagiline), ND0612 (Levodopa/Carbidopa), Tavapadon, and others.

- In December 2024, AbbVie announced positive topline results from the pivotal Phase III TEMPO-2 trial of tavapadon, a first-in-class D1/D5 partial agonist under investigation as a once-daily treatment for Parkinson’s disease. The trial met primary and secondary endpoints, demonstrating significant improvement in motor function. AbbVie plans to submit a New Drug Application (NDA) to the FDA in 2025.

- In November 2024, Sunbird Bio released new data showing that its diagnostic technology successfully classified blood samples from Parkinson's disease-positive patients with 86% accuracy by directly detecting aggregated alpha-synuclein proteins.

- In October 2024, AbbVie announced that it had received FDA approval for VYALEV (foscarbidopa/foslevodopa), a treatment for motor fluctuations in adults with advanced Parkinson's disease. This marks the first 24-hour continuous subcutaneous infusion of a levodopa-based therapy.

Discover which therapies are expected to grab the Parkinson's disease market share @ Parkinson's Disease Market Report

Parkinson's Disease Overview

Parkinson's disease is a neurodegenerative disorder that primarily affects movement control. It occurs due to the gradual loss of dopamine-producing neurons in the brain, particularly in the substantia nigra, an area responsible for regulating voluntary motor movements. The exact cause of this neuron degeneration is still not fully understood, but it is believed to be a combination of genetic, environmental, and age-related factors. In some cases, genetic mutations contribute to the disease, but for most individuals, it is idiopathic, meaning the cause is unknown.

The symptoms of Parkinson's disease develop slowly and worsen over time. Early signs often include tremors, especially at rest, muscle rigidity, bradykinesia (slowness of movement), and postural instability, which can lead to balance problems and falls. As the disease progresses, individuals may experience difficulties with speech, swallowing, and sleep disturbances. Cognitive decline and mood disorders, such as depression and anxiety, are also common.

Diagnosis of Parkinson's disease is primarily clinical, meaning it is based on a detailed patient history and a physical examination by a neurologist. There is no definitive test for PD, but neuroimaging techniques such as MRI or dopamine transporter (DAT) scans can support the diagnosis by showing changes in the brain associated with the disease. Genetic testing and blood tests may be used in cases with a known family history, but they are not routine for most individuals with PD. Early diagnosis and intervention are key to managing symptoms and improving the quality of life for patients.

Parkinson's Disease Epidemiology Segmentation

The Parkinson's disease epidemiology section provides insights into the historical and current Parkinson's disease patient pool and forecasted trends for the 7MM. It helps recognize the causes of current and forecasted patient trends by exploring numerous studies and views of key opinion leaders.

The Parkinson's disease market report proffers epidemiological analysis for the study period 2020–2034 in the 7MM segmented into:

- Total Diagnosed Prevalent Cases of Parkinson’s Disease

- Gender-specific Diagnosed Prevalent Cases of Parkinson’s Disease

- Age-specific Diagnosed Prevalent Cases of Parkinson’s Disease

- Stage-specific Diagnosed Prevalent Cases of Parkinson’s Disease

- Diagnosed Prevalent Cases of Psychosis due to Parkinson's Disease

- Diagnosed Prevalent Cases of MCI due to Parkinson's Disease

Download the report to understand which factors are driving Parkinson's disease epidemiology trends @ Parkinson's Disease Epidemiological Insights

Parkinson's Disease Treatment Market

Although there is currently no cure for Parkinson's disease, various pharmacological and non-pharmacological treatments are combined to manage its symptoms effectively. Physical, occupational, and speech therapy play vital roles in the treatment plan, while surgical interventions can be beneficial for certain patients. Additionally, complementary therapies may help address specific symptoms of the disease.

Commonly used medications for Parkinson’s disease include levodopa, dopamine agonists, MAO-B inhibitors, COMT inhibitors, amantadine, anticholinergics, and adenosine A2A antagonists. These treatments primarily aim to alleviate motor symptoms, which significantly impact movement in individuals with Parkinson's.

Levodopa introduced about 30 years ago, is often considered the cornerstone of Parkinson’s treatment. It crosses the blood-brain barrier—an intricate network of blood vessels and cells that filters blood entering the brain—where it is converted into dopamine. This process significantly enhances the quality of life for many patients. However, levodopa can cause side effects such as nausea, vomiting, dry mouth, and dizziness. At higher doses, it may lead to dyskinesia (involuntary movements) and, in some cases, confusion, hallucinations, or psychosis.

Carbidopa/levodopa is the most effective treatment for managing the motor symptoms of Parkinson's disease. This combination is approved as a standalone therapy and is frequently the first choice for patients with motor symptoms, particularly those with late-onset disease. Approved medications containing levodopa/carbidopa include SINEMET, SINEMET CR, PARCOPA, RYTARY, and DUOPA.

Learn more about the market of Parkinson's disease @ Parkinson's Disease Treatment

Parkinson's Disease Emerging Drugs and Companies

Some of the drugs in the pipeline include Solengepras (Cerevance), Minzasolmin (UCB Biopharma SRL/Novartis), Buntanetap (Annovis Bio), and others.

Solengepras is a pioneering non-dopaminergic therapy designed to target GPR6, an orphan G-protein-coupled receptor predominantly located in the striatal projection neurons of the indirect (striatopallidal) pathway, which plays a critical role in movement regulation. By modulating this pathway, Solengepras has demonstrated potential benefits in Parkinson’s disease, including a reduction of OFF time by 1.59 hours compared to placebo, without the usual dopaminergic side effects.

The treatment shows promise for improving both motor and non-motor symptoms and may help delay disease progression, representing a significant advance in Parkinson’s care. Currently, in Phase III clinical trials, Solengepras is being developed as a potentially disease-modifying therapy for Parkinson’s disease.

In November 2024, Cerevance announced the dosing of the first patient in its pivotal Phase III ARISE trial, evaluating solengepras as a potential adjunctive treatment for Parkinson's disease. Cerevance expects to report topline data in the first half of 2026.

Minzasolmin is an experimental small molecule designed to address Parkinson's disease by inhibiting the misfolding and accumulation of alpha-synuclein, a key protein involved in the disease's progression. By targeting alpha-synuclein misfolding, minzasolmin shows promise in slowing the advancement of Parkinson’s. Initially discovered by Neuropore and licensed to UCB in 2014, it is part of a broader class of related compounds. In December 2021, UCB partnered with Novartis to globally co-develop and co-commercialize UCB0599, a pioneering alpha-synuclein misfolding inhibitor currently in Phase II clinical trials for Parkinson’s disease.

Buntanetap, formerly known as ANVS401, ANVS402, or posiphen, is an oral small molecule categorized as a Translational Inhibitor of Neurotoxic Aggregating Proteins (TINAPs). It functions by reducing neurotoxic protein levels, thereby alleviating brain toxicity. Its mechanism of action targets the production of multiple neurotoxic proteins—such as APP/Aβ, tau/phospho-tau, and α-synuclein—addressing a key driver of neurodegeneration.

The drug has successfully completed Phase III trials for early-stage Parkinson's disease. Annovis Bio has scheduled a meeting with the FDA in Q1 2025 to determine the development path forward for Buntanetap in the treatment of Parkinson’s disease. Buntanetap is also being developed for Alzheimer’s disease, Lewy Body Dementia, and other neurodegenerative disorders.

The other pipeline therapies for Parkinson's disease include

- SPN-830 (Apomorphine Infusion): Supernus Pharmaceuticals, Inc./Britannia Pharmaceutical

- P2B001 (Extended-release Pramipexole and Rasagiline): Pharma Two B

- ND0612 (Levodopa/Carbidopa): Mitsubishi Tanabe Pharma (NeuroDerm)

- Tavapadon: AbbVie/Cerevel Therapeutics, LLC

The anticipated launch of these emerging therapies are poised to transform the Parkinson's disease market landscape in the coming years. As these cutting-edge therapies continue to mature and gain regulatory approval, they are expected to reshape the Parkinson's disease market landscape, offering new standards of care and unlocking opportunities for medical innovation and economic growth.

To know more about Parkinson's disease clinical trials, visit @ Parkinson's Disease Treatment Drugs

Parkinson's Disease Market Dynamics

The Parkinson's disease market dynamics are anticipated to change in the coming years. The rising prevalence of Parkinson’s disease, coupled with an aging population, has created a larger target pool for key players, while ongoing research has enhanced our understanding of the disease, leading to innovative treatments utilizing novel technologies and routes of administration, such as infusion pumps, intranasal delivery, inhalation, and intraputaminal approaches.

Additionally, the lack of curative therapies presents a significant opportunity for pharmaceutical companies to innovate and develop effective treatments with minimal or no side effects. Advances in imaging techniques and biomarker research further support this progress by enabling earlier detection and intervention, potentially slowing disease progression.

Furthermore, many potential therapies are being investigated for the treatment of Parkinson's disease, and it is safe to predict that the treatment space will significantly impact the Parkinson's disease market during the forecast period. Moreover, the anticipated introduction of emerging therapies with improved efficacy and a further improvement in the diagnosis rate is expected to drive the growth of the Parkinson's disease market in the 7MM.

However, several factors may impede the growth of the Parkinson's disease market. Current treatment options for Parkinson’s disease are limited to alleviating symptoms, often accompanied by undesirable side effects like hallucinations and cognitive impairment. The absence of reliable diagnostic tools for early detection, combined with unclear pathophysiology and disease heterogeneity, complicates understanding the disease processes and developing effective treatment regimes. Furthermore, the increasing use of off-label treatments is impacting market share and profitability, ultimately affecting overall revenue.

Moreover, Parkinson's disease treatment poses a significant economic burden and disrupts patients’ overall well-being and QOL. Furthermore, the Parkinson's disease market growth may be offset by failures and discontinuation of emerging therapies, unaffordable pricing, market access and reimbursement issues, and a shortage of healthcare specialists. In addition, the undiagnosed, unreported cases and the unawareness about the disease may also impact the Parkinson's disease market growth.

| Parkinson's Disease Report Metrics | Details |

| Study Period | 2020–2034 |

| Parkinson's Disease Report Coverage | 7MM [The United States, the EU-4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan] |

| Parkinson's Disease Market Size in 2023 | USD 3.2 Billion |

| Key Parkinson's Disease Companies | UCB Biopharma SRL, Novartis, Annovis Bio, Supernus Pharmaceuticals, Inc., Britannia Pharmaceutical, Pharma Two B, Mitsubishi Tanabe Pharma (NeuroDerm), AbbVie, Cerevel Therapeutics, LLC, Cerevance, and others |

| Key Parkinson's Disease Therapies | Solengepras (CVN424), Minzasolmin (UCB0599), Buntanetap (ANVS401/Posiphen), SPN-830 (Apomorphine Infusion), P2B001 (Extended-release Pramipexole and Rasagiline), ND0612 (Levodopa/Carbidopa), Tavapadon, and others |

Scope of the Parkinson's Disease Market Report

- Parkinson's Disease Therapeutic Assessment: Parkinson's Disease current marketed and emerging therapies

- Parkinson's Disease Market Dynamics: Conjoint Analysis of Emerging Parkinson's Disease Drugs

- Competitive Intelligence Analysis: SWOT analysis and Market entry strategies

- Unmet Needs, KOL’s views, Analyst’s views, Parkinson's Disease Market Access and Reimbursement

Discover more about Parkinson's disease drugs in development @ Parkinson's Disease Clinical Trials

Table of Contents

| 1 | Key Insights |

| 2 | Report Introduction |

| 3 | Parkinson’s Disease Market Overview at a Glance |

| 3.1 | Market Share (%) Distribution of Parkinson’s Disease in 2020 |

| 3.2 | Market Share (%) Distribution of Parkinson’s Disease in 2034 |

| 4 | Methodology of Parkinson’s Disease Epidemiology and Market |

| 5 | Executive Summary of Parkinson’s Disease |

| 6 | Key Events |

| 7 | Disease Background and Overview |

| 7.1 | Introduction |

| 7.2 | Classification |

| 7.3 | Signs and Symptoms |

| 7.4 | Risk Factors |

| 7.5 | Pathophysiology |

| 7.6 | Diagnosis |

| 7.6.1 | Biomarker |

| 7.6.2 | Diagnostic Guidelines |

| 7.6.2.1 | American Academy of Family Physicians |

| 7.6.2.2 | European Federation of Neurological Societies/Movement Disorder Society- European Section (EFNS/MDS-ES) Recommendations for the Diagnosis of Parkinson’s Disease |

| 7.6.2.3 | The National Institute for Health and Care Excellence (NICE): Recommendation for Diagnosis of Parkinson’s Disease |

| 7.6.2.4 | Movement Disorder Society (MDS) Clinical Diagnostic Criteria for Parkinson’s Disease |

| 7.6.3 | Diagnostic Algorithm |

| 7.6.4 | Differential Diagnosis |

| 7.7 | Treatment |

| 7.7.1 | Treatment Algorithm |

| 7.7.2 | Treatment Guidelines |

| 7.7.2.1 | National Institute for Health and Care Excellence (NICE): Recommendation for Parkinson’s disease |

| 7.7.2.2 | American Academy of Neurology (AAN) Guidelines for Treatment of Early Parkinson’s Disease |

| 7.7.2.3 | Clinical Practice Guidelines by the NHS Spain |

| 7.7.2.4 | Clinical Practice Guidelines by the Japanese Society of Neurology (JSN) |

| 7.7.2.5 | Guideline of the German Society for Neurology |

| 8 | Epidemiology and Patient Population |

| 8.1 | Key Findings |

| 8.2 | Assumptions and Rationale: The 7MM |

| 8.2.1 | Diagnosed Prevalent Cases of Parkinson’s Disease |

| 8.2.2 | Gender-specific Diagnosed Prevalent Cases of Parkinson’s Disease |

| 8.2.3 | Age-specific Diagnosed Prevalent Cases of Parkinson’s Disease |

| 8.2.4 | Stage-specific Diagnosed Prevalent Cases of Parkinson’s Disease |

| 8.2.5 | Diagnosed Prevalent Cases of Psychosis in Parkinson’s Disease |

| 8.2.6 | Diagnosed Prevalent Cases of MCI due to Parkinson's Disease |

| 8.3 | Total Diagnosed Prevalent Cases of Parkinson’s Disease in the 7MM |

| 8.4 | The United States |

| 8.4.1 | Total Diagnosed Prevalent Cases of Parkinson’s Disease in the US |

| 8.4.2 | Gender-specific Diagnosed Prevalent Cases of Parkinson’s Disease in the US |

| 8.4.3 | Age-specific Diagnosed Prevalent Cases of Parkinson’s Disease in the US |

| 8.4.4 | Stage-specific Diagnosed Prevalent Cases of Parkinson’s Disease in the US |

| 8.4.5 | Diagnosed Prevalent Cases of Psychosis due to Parkinson's Disease in the US |

| 8.4.6 | Diagnosed Prevalent Cases of MCI due to Parkinson's Disease in the US |

| 8.5 | EU4 and the UK |

| 8.5.1 | Germany |

| 8.5.1.1 | Total Diagnosed Prevalent Cases of Parkinson’s Disease in Germany |

| 8.5.1.2 | Gender-specific Diagnosed Prevalent Cases of Parkinson’s Disease in Germany |

| 8.5.1.3 | Age-specific Diagnosed Prevalent Cases of Parkinson’s Disease in Germany |

| 8.5.1.4 | Stage-specific Diagnosed Prevalent Cases of Parkinson’s Disease in Germany |

| 8.5.1.5 | Diagnosed Prevalent Cases of Psychosis due to Parkinson's Disease in Germany |

| 8.5.1.6 | Diagnosed Prevalent Cases of MCI due to Parkinson's Disease in Germany |

| 8.5.2 | France |

| 8.5.2.1 | Total Diagnosed Prevalent Cases of Parkinson’s Disease in France |

| 8.5.2.2 | Gender-specific Diagnosed Prevalent Cases of Parkinson’s Disease in France |

| 8.5.2.3 | Age-specific Diagnosed Prevalent Cases of Parkinson’s Disease in France |

| 8.5.2.4 | Stage-specific Diagnosed Prevalent Cases of Parkinson’s Disease in France |

| 8.5.2.5 | Diagnosed Prevalent Cases of Psychosis due to Parkinson's Disease in France |

| 8.5.2.6 | Diagnosed Prevalent Cases of MCI due to Parkinson's Disease in France |

| 8.5.3 | Italy |

| 8.5.3.1 | Total Diagnosed Prevalent Cases of Parkinson’s Disease in Italy |

| 8.5.3.2 | Gender-specific Diagnosed Prevalent Cases of Parkinson’s Disease in Italy |

| 8.5.3.3 | Age-specific Diagnosed Prevalent Cases of Parkinson’s Disease in Italy |

| 8.5.3.4 | Stage-specific Diagnosed Prevalent Cases of Parkinson’s Disease in Italy |

| 8.5.3.5 | Diagnosed Prevalent Cases of Psychosis due to Parkinson's Disease in Italy |

| 8.5.3.6 | Diagnosed Prevalent Cases of MCI due to Parkinson's Disease in Italy |

| 8.5.4 | Spain |

| 8.5.4.1 | Total Diagnosed Prevalent Cases of Parkinson’s Disease in Spain |

| 8.5.4.2 | Gender-specific Diagnosed Prevalent Cases of Parkinson’s Disease in Spain |

| 8.5.4.3 | Age-specific Diagnosed Prevalent Cases of Parkinson’s Disease in Spain |

| 8.5.4.4 | Stage-specific Diagnosed Prevalent Cases of Parkinson’s Disease in Spain |

| 8.5.4.5 | Diagnosed Prevalent Cases of Psychosis due to Parkinson's Disease in Spain |

| 8.5.4.6 | Diagnosed Prevalent Cases of MCI due to Parkinson's Disease in Spain |

| 8.5.5 | The United Kingdom |

| 8.5.5.1 | Total Diagnosed Prevalent Cases of Parkinson’s Disease in the UK |

| 8.5.5.2 | Gender-specific Diagnosed Prevalent Cases of Parkinson’s Disease in the UK |

| 8.5.5.3 | Age-specific Diagnosed Prevalent Cases of Parkinson’s Disease in the UK |

| 8.5.5.4 | Stage-specific Diagnosed Prevalent Cases of Parkinson’s Disease in the UK |

| 8.5.5.5 | Diagnosed Prevalent Cases of Psychosis due to Parkinson's Disease in the UK |

| 8.5.5.6 | Diagnosed Prevalent Cases of MCI due to Parkinson's Disease in the UK |

| 8.6 | Japan |

| 8.6.1 | Total Diagnosed Prevalent Cases of Parkinson’s Disease in Japan |

| 8.6.2 | Gender-specific Diagnosed Prevalent Cases of Parkinson’s Disease in Japan |

| 8.6.3 | Age-specific Diagnosed Prevalent Cases of Parkinson’s Disease in Japan |

| 8.6.4 | Stage-specific Diagnosed Prevalent Cases of Parkinson’s Disease in Japan |

| 8.6.5 | Diagnosed Prevalent Cases of Psychosis due to Parkinson's Disease in Japan |

| 8.6.6 | Diagnosed Prevalent Cases of MCI due to Parkinson's Disease in Japan |

| 9 | Patient Journey |

| 10 | Marketed Therapies |

| 10.1 | Key Cross Competition of Marketed Drugs |

| 10.2 | XADAGO/EQUFINA (Safinamide): Newron Pharmaceuticals/ Zambon/Supernus Pharmaceuticals/Eisai |

| 10.2.1 | Product Description |

| 10.2.2 | Regulatory Milestones |

| 10.2.3 | Other Development Activities |

| 10.2.4 | Clinical Trial Information |

| 10.2.5 | Safety and Efficacy |

| 10.3 | NOURIANZ/NOURIAST (Istradefylline): Kyowa Kirin |

| 10.3.1 | Product Description |

| 10.3.2 | Regulatory Milestones |

| 10.3.3 | Other Development Activities |

| 10.3.4 | Clinical Trial Information |

| 10.3.5 | Safety and Efficacy |

| 10.4 | DUOPA/DUODOPA (Carbidopa and Levodopa-ES): AbbVie |

| 10.4.1 | Production Description |

| 10.4.2 | Regulatory Milestones |

| 10.4.3 | Other Development Activities |

| 10.4.4 | Clinical Trial Information |

| 10.4.5 | Safety and Efficacy |

| 10.5 | INBRIJA (Levodopa): Acorda Therapeutics/Esteve Pharmaceuticals |

| 10.5.1 | Production Description |

| 10.5.2 | Regulatory milestones |

| 10.5.3 | Other Development Activities |

| 10.5.4 | Clinical Trial Information |

| 10.5.5 | Safety and Efficacy |

| 10.6 | GOCOVRI (Amantadine): Supernus Pharmaceuticals |

| 10.6.1 | Product Description |

| 10.6.2 | Other Development Activities |

| 10.6.3 | Regulatory Milestones |

| 10.6.4 | Clinical Trial Information |

| 10.6.5 | Safety and Efficacy |

| 10.7 | ONGENTYS (Opicapone): Neurocrine Biosciences/BIAL/Ono Pharmaceutical |

| 10.7.1 | Product Description |

| 10.7.2 | Regulatory Milestones |

| 10.7.3 | Other Development Activities |

| 10.7.4 | Clinical Trial Information |

| 10.7.5 | Safety and Efficacy |

| 10.8 | HARUROPI TAPE (Ropinirole HCL): Hisamitsu Pharmaceutical/Kyowa Kirin |

| 10.8.1 | Production Description |

| 10.8.2 | Regulatory Milestones |

| 10.8.3 | Other Development Activities |

| 10.8.4 | Safety and Efficacy |

| 10.9 | NEUPRO/ Rotigotine Transdermal: UCB |

| 10.9.1 | Product Description |

| 10.9.2 | Regulatory Milestone |

| 10.9.3 | Other Development Activities |

| 10.9.4 | Safety and Efficacy |

| 10.1 | RYTARY (Carbidopa and Levodopa): Amneal Pharmaceuticals |

| 10.10.1 | Product Description |

| 10.10.2 | Regulatory Milestone |

| 10.10.3 | Other Development Activities |

| 10.10.4 | Clinical Trial Information |

| 10.10.5 | Safety and Efficacy |

| 10.11 | ABBV951/ PRODUODOPA/ VYALEV (Foscarbidopa/ Foslevodopa): AbbVie |

| 10.11.1 | Product Description |

| 10.11.2 | Regulatory Milestone |

| 10.11.3 | Other Development Activities |

| 10.11.4 | Clinical Trials Information |

| 10.11.5 | Safety and Efficacy |

| 10.12 | CREXONT/IPX203: Amneal Pharmaceuticals |

| 10.12.1 | Product Description |

| 10.12.2 | Regulatory Milestone |

| 10.12.3 | Other Development Activities |

| 10.12.4 | Clinical Trial Information |

| 10.12.5 | Safety and Efficacy |

| 11 | Emerging Drug Profiles |

| 11.1 | Key Cross Competition |

| 11.2 | Solengepras (CVN424): Cerevance |

| 11.2.1 | Product Description |

| 11.2.2 | Other Developmental Activities |

| 11.2.3 | Clinical Trials Information |

| 11.2.4 | Safety and Efficacy |

| 11.2.5 | Analyst Views |

| 11.3 | Minzasolmin (UCB0599): UCB Biopharma SRL/Novartis |

| 11.3.1 | Product Description |

| 11.3.2 | Other Developmental Activities |

| 11.3.3 | Clinical Trials Information |

| 11.3.4 | Safety and Efficacy |

| 11.3.5 | Analyst Views |

| 11.4 | Buntanetap (ANVS401/Posiphen): Annovis Bio |

| 11.4.1 | Product Description |

| 11.4.2 | Other Development Activities |

| 11.4.3 | Clinical Trial Information |

| 11.4.4 | Safety and Efficacy |

| 11.4.5 | Analyst Views |

| 11.5 | SPN-830 (Apomorphine Infusion): Supernus Pharmaceuticals, Inc./ Britannia Pharmaceutical |

| 11.5.1 | Product Description |

| 11.5.2 | Other Development Activities |

| 11.5.3 | Clinical Trials Information |

| 11.5.4 | Safety and Efficacy |

| 11.5.5 | Analyst Views |

| 11.6 | P2B001 (Extended-release Pramipexole and Rasagiline): Pharma Two B |

| 11.6.1 | Product Description |

| 11.6.2 | Other Development Activities |

| 11.6.3 | Clinical Trials Information |

| 11.6.4 | Safety and Efficacy |

| 11.6.5 | Analyst Views |

| 11.7 | ND0612 (Levodopa/Carbidopa): Mitsubishi Tanabe Pharma (NeuroDerm) |

| 11.7.1 | Product Description |

| 11.7.2 | Other Development Activities |

| 11.7.3 | Clinical Trials Information |

| 11.7.4 | Safety and Efficacy |

| 11.7.5 | Analyst Views |

| 11.8 | Tavapadon: AbbVie/Cerevel Therapeutics, LLC |

| 11.8.1 | Product Description |

| 11.8.2 | Other Development Activities |

| 11.8.3 | Clinical Trial Information |

| 11.8.4 | Safety and Efficacy |

| 11.8.5 | Analyst Views |

| 12 | Parkinson’s disease: Market Analysis |

| 12.1 | Key Findings |

| 12.2 | Market Outlook |

| 12.3 | Key Market Forecast Assumptions |

| 12.4 | Conjoint Analysis |

| 12.5 | Total Market Size of Parkinson’s Disease in the 7MM |

| 12.6 | Market Size of Parkinson’s Disease by Therapies in the 7MM |

| 12.7 | Market Size of Parkinson’s Disease in the United States |

| 12.7.1 | Total Market Size of Parkinson’s Disease |

| 12.7.2 | Market Size of Parkinson’s Disease by Therapies in the United States |

| 12.8 | Market Size of Parkinson’s Disease in EU4 and the UK |

| 12.8.1 | Market Size of Parkinson’s Disease in Germany |

| 12.8.1.1 | Total Market Size of Parkinson’s Disease |

| 12.8.1.2 | Market Size of Parkinson’s Disease by Therapies in Germany |

| 12.8.2 | Market Size of Parkinson’s Disease in France |

| 12.8.2.1 | Total Market Size of Parkinson’s Disease |

| 12.8.2.2 | Market Size of Parkinson’s Disease by Therapies in France |

| 12.8.3 | Market Size of Parkinson’s Disease in Italy |

| 12.8.3.1 | Total Market Size of Parkinson’s Disease |

| 12.8.3.2 | Market Size of Parkinson’s Disease by Therapies in Italy |

| 12.8.4 | Market Size of Parkinson’s Disease in Spain |

| 12.8.4.1 | Total Market Size of Parkinson’s Disease |

| 12.8.4.2 | Market Size of Parkinson’s Disease by Therapies in Spain |

| 12.8.5 | Market Size of Parkinson’s Disease in the UK |

| 12.8.5.1 | Total Market Size of Parkinson’s Disease |

| 12.8.5.2 | Market Size of Parkinson’s Disease by Therapies in the UK |

| 12.9 | Market Size of Parkinson’s Disease in Japan |

| 12.9.1 | Total Market Size of Parkinson’s Disease |

| 12.9.2 | Market Size of Parkinson’s Disease by Therapies in Japan |

| 13 | Key Opinion Leaders’ Views |

| 14 | SWOT Analysis |

| 15 | Unmet Needs |

| 16 | Market Access and Reimbursement |

| 16.1 | The United States |

| 16.1.1 | Center for Medicare and Medicaid Services (CMS) |

| 16.2 | In EU4 and the UK |

| 16.2.1 | Germany |

| 16.2.2 | France |

| 16.2.3 | Italy |

| 16.2.4 | Spain |

| 16.2.5 | The United Kingdom |

| 16.3 | Japan |

| 16.3.1 | MHLW |

| 17 | Appendix |

| 17.1 | Bibliography |

| 17.2 | Acronyms and Abbreviations |

| 17.3 | Report Methodology |

| 18 | DelveInsight Capabilities |

| 19 | Disclaimer |

| 20 | About DelveInsight |

Related Reports

Parkinson's Disease Pipeline Insight – 2024 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key Parkinson's disease companies, including Cerevel Therapeutics, Inhibikase Therapeutics, Neuraly, Peptron, Biogen, Roche, Brain Neurotherapy Bio, Inc., Modag, Annovis Bio Inc., BioVie Inc., United Neuroscience Ltd., Luye Pharma Group, AbbVie, UCB Biopharma SRL, InnoMedica Schweiz AG, Integrative Research Laboratories AB, H. Lundbeck A/S, Shanghai WD Pharmaceutical Co., Ltd., Cerevance Beta, Inc., Nobilis Therapeutics Inc., BlueRock Therapeutics, Taiwan Mitochondrion Applied Technology Co., Ltd., among others.

Cell and Gene Therapy in Parkinson's Disease Market

Cell and Gene Therapy in Parkinson's Disease Market Insights, Epidemiology, and Market Forecast – 2034 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key cell and gene therapy in Parkinson's disease companies including MeiraGTx, Hope Biosciences, Sumitomo Pharma, Prevail Therapeutics, BlueRock Therapeutics, Voyager Therapeutics, among others.

Parkinson's Disease Psychosis Market

Parkinson's Disease Psychosis Market Insights, Epidemiology, and Market Forecast – 2034 report delivers an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key Parkinson’s disease psychosis companies, including Sumitomo Pharma America Inc., Vanda Pharmaceuticals, Acadia Pharmaceuticals Inc., Otsuka America Pharmaceutical, Lundbeck LLC, Jazz Pharmaceuticals, Alkahest Inc., Sandoz, Sio Gene Therapies, Axovant Sciences Ltd, among others.

Parkinson’s Disease-Related Dementia Market

Parkinson's Disease-Related Dementia Market Insights, Epidemiology, and Market Forecast – 2034 report delivers an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key Parkinson’s disease-related dementia companies, including AbbVie, UCB Biopharma SRL, InnoMedica Schweiz AG, Integrative Research Laboratories AB, H. Lundbeck A/S, Shanghai WD Pharmaceutical Co., Ltd., Cerevance Beta, Inc., among others.

Psychosis in Parkinson’s and Alzheimer’s Disease Market

Psychosis in Parkinson’s and Alzheimer’s Disease Market Insights, Epidemiology, and Market Forecast – 2034 report delivers an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key psychosis in Parkinson’s and Alzheimer’s disease companies, including Sunovion Pharmaceuticals, Karuna Therapeutics, Vanda Pharmaceuticals, Suven Life Sciences, Enterin, Intra-Cellular Therapies, Merck Sharp & Dohme, among others.

DelveInsight’s Pharma Competitive Intelligence Service: Through its CI solutions, DelveInsight provides its clients with real-time and actionable intelligence on their competitors and markets of interest to keep them stay ahead of the competition by providing insights into the latest therapeutic area-specific/indication-specific market trends, in emerging drugs, and competitive strategies. These services are tailored to the specific needs of each client and are delivered through a combination of reports, dashboards, and interactive presentations, enabling clients to make informed decisions, mitigate risks, and identify opportunities for growth and expansion.

Other Business Consulting Services

Healthcare Conference Coverage

Discover how a mid-pharma client gained a level of confidence in their soon-to-be partner for manufacturing their therapeutics by downloading our Due Diligence Case Study

About DelveInsight

DelveInsight is a leading Business Consultant and Market Research firm focused exclusively on life sciences. It supports pharma companies by providing comprehensive end-to-end solutions to improve their performance. Get hassle-free access to all the healthcare and pharma market research reports through our subscription-based platform PharmDelve.

Connect with us on LinkedIn|Facebook|Twitter

Contact Us

Shruti Thakur

info@delveinsight.com

+14699457679

www.delveinsight.com

Distribution channels: Healthcare & Pharmaceuticals Industry, Media, Advertising & PR, Science ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release