Anti-ESG Shareholder Proposals in 2025

![]() Companies and investors use information related to environmental, social or governance (“ESG”) factors to provide a company-wide view of sustainability and other priorities. This includes how the company discloses, reacts to and manages ESG-related risks and policies, such as, for example, risks related to carbon emissions, as well as policies addressing diversity, shareholder rights and corporate social responsibility. These topics are often the subject of shareholder proposals advocating additional disclosure or policies in furtherance of ESG-related goals. In contrast, “anti-ESG proposals” are generally critical of, or question the value of, company policies or initiatives related to these topics. As of the midpoint of the 2025 proxy season, “anti-ESG” proposals have become more common, a trend mirroring that seen in recent years. In addition, proponents that, in past proxy seasons, submitted proposals on clearly anti-ESG topics, such as opposition to climate change-based initiatives, are now submitting proposals on a broader array of topics.

Companies and investors use information related to environmental, social or governance (“ESG”) factors to provide a company-wide view of sustainability and other priorities. This includes how the company discloses, reacts to and manages ESG-related risks and policies, such as, for example, risks related to carbon emissions, as well as policies addressing diversity, shareholder rights and corporate social responsibility. These topics are often the subject of shareholder proposals advocating additional disclosure or policies in furtherance of ESG-related goals. In contrast, “anti-ESG proposals” are generally critical of, or question the value of, company policies or initiatives related to these topics. As of the midpoint of the 2025 proxy season, “anti-ESG” proposals have become more common, a trend mirroring that seen in recent years. In addition, proponents that, in past proxy seasons, submitted proposals on clearly anti-ESG topics, such as opposition to climate change-based initiatives, are now submitting proposals on a broader array of topics.

As of June 3, 2025, conservative proponents that traditionally submitted anti-ESG proposals had submitted an aggregate of approximately 120 shareholder proposals. This is approximately the same number of proposals as were submitted by the same group of proponents during the 2024 proxy season. Approximately 50 (45%) of the 2025 proposals have been voted on to date and, notably, just as in 2024, none of these proposals has received a majority shareholder vote. About 15% have yet to be voted on, while the remaining approximately 40% were not subject to a shareholder vote, generally because they were withdrawn by the proponent or the company was permitted to omit the proposal via the U.S. Securities and Exchange Commission’s (the “SEC”) no-action request process. Support levels for proposals ranged from a low of 0.20% to a high of almost 12%, with a median support level of 1.4%. This is similar to the low of 0.03% support received in 2023; however, proposals received as high as approximately 36% support in 2024. Notably, however, at the midpoint of the 2024 proxy season, anti-ESG proposals had received a median support level of approximately 1.5%, showing that support for these proposals overall remains steadily low year over year.

No-Action Requests Related to Anti-ESG Proposals

Pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the SEC agrees that it will not take action against companies that omit shareholder proposals that meet certain criteria detailed in Rule 14a-8. To date, in the 2025 proxy season, companies submitted approximately 55 no-action requests for proposals received from proponents that typical submit anti-ESG proposals. This represents a significant increase from the approximately 40 requests submitted to the SEC staff (the “Staff”) during the 2024 proxy season.

So far in 2025, the Staff has agreed that it would take no action in connection with the omission of 30 such proposals, or slightly more than half, an increase from the 40% of requests on which the Staff agreed to take no action in 2024. In 2025, these proposals spanned a wide-cross-section of issues, with multiple proposals touching on traditional anti-ESG topics such as (i) greenhouse gas (“GHG”) emissions, (ii) risks related to religious discrimination, (iii) the use of diversity, equity and inclusion (“DEI”) goals in setting executive compensation and (iv) requests that companies consider abolishing their DEI policies and goals. However, multiple proposals requested assessments by a company’s board of directors “to determine if adding Bitcoin to the company’s treasury is in the best long-term interests of shareholders.” Bitcoin was the subject of only one anti-ESG proponent shareholder proposal in 2024, which, since this topic is outside of those generally considered to be anti-ESG, might show that proposal proponents are expanding their interests.

The approximately 25 proposals that the Staff declined to omit spanned a similar cross-section of issues, perhaps evidencing that the Staff considers the unique facts and circumstances of each company in determining whether to grant a no-action request. These topics include requests that companies (i) consider abolishing DEI programs and goals, (ii) revisit the use of DEI goals in setting executive compensation, (iii) report on how their charitable contributions “impact risks related to discrimination against individuals based on their speech or religious exercise” and (iv) report on oversight of “risks related to discrimination against ad buyers and sellers based on their political or religious status or views.” Interestingly, almost all of these proposals were confined to traditional anti-ESG topics, with a strong leaning toward proposals related to potential discrimination regarding free speech and/or religious exercise. The proposals that have been voted on received favorable votes ranging from 0.20% to almost 9%; however, all but one proposal received support of approximately 2% or less.

Topics and Trends in Anti-ESG Proposals

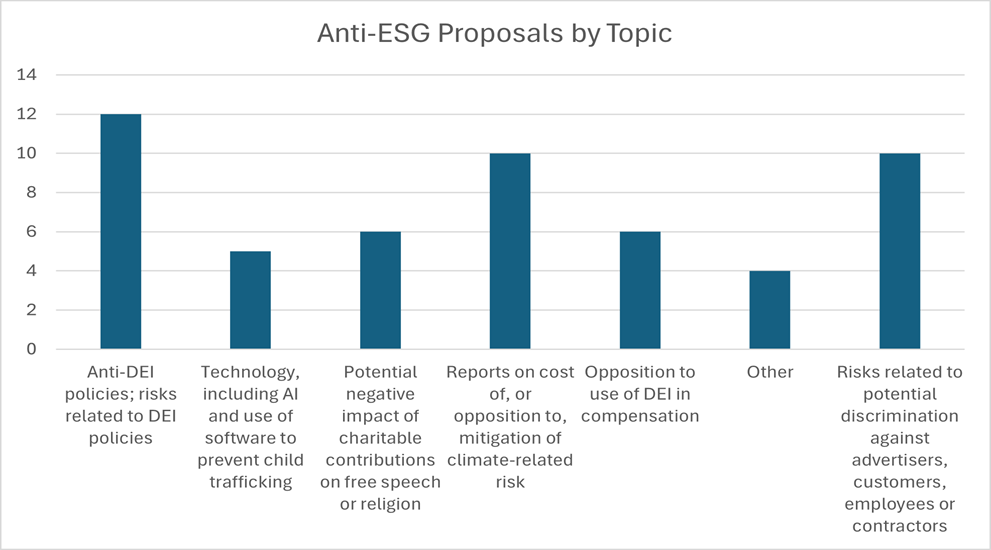

A majority of the anti-ESG proposals voted on so far in 2025 deal with topics thought to be traditionally anti-ESG, such as challenging DEI programs or opposing efforts to mitigate climate change. The proposals can be categorized as follows:

The proposals can be further cataloged as follows:

Anti-DEI Proposals

Collectively, proposals touching on DEI, such as (i) opposing the use of DEI in setting executive compensation, (ii) requesting that companies consider abolishing DEI policies or (iii) asking for reports on the risks of such policies, constitute more than 40% of the anti-ESG proposals voted on to date in 2025. These proposals received a maximum of around 3% of shareholder support. Anti-DEI proposals were less common in 2024, with only two proposals opposing the use of DEI in executive compensation, and an additional approximately 10 proposals asking for reporting topics such as the “potential risks associated with omitting “viewpoint” and “ideology” from its written equal employment opportunity policy” or the “impacts of DEI policies on civil rights, non-discrimination and return to merit, and the impacts of those issues on the Company’s business.” Anti-DEI proposals in 2025 tended to be more strongly worded, including clear requests that companies consider abolishing DEI policies altogether, perhaps reflecting the current political climate in the United States. In both years, to date, all proposals received low levels of shareholder support.

Proposals Regarding Free Speech and Religious Exercise

A large number of anti-ESG proposals in both 2024 and 2025 focused on the views expressed and the policy positions taken by companies, officers and directors, and the potential impact of such views and actions on the company’s financial condition. Proposals seemed to focus on two main areas: risk of negative impacts of certain charitable giving and risks of discrimination via policy or action.

Charitable Giving

In both 2024 and 2025, a number of anti-ESG proposals centered on charitable giving. In 2025 to date, approximately five companies received a proposal requesting an analysis of how a company’s “contributions impact its risks related to discrimination against individuals based on their speech or religious exercise.” In addition, a very small number of proponents requested the creation of a board committee to oversee and/or a report on the impact of a company’s policies and/or charitable giving on its financial sustainability, generally alleging that companies contribute to organizations that “attack free speech and religious freedoms.” However, in 2024, approximately 12 companies received an almost identical proposal to the latter, supported, at least in some cases, by the statement that “company bottom-lines, and therefore value to shareholders, drop when companies take overtly political and divisive positions that alienate consumers.” Taken together, this may demonstrate that investors’ interest in charitable giving continues to evolve. In 2024 and to date in 2025, these proposals all received low levels of shareholder support.

Risks of Discrimination via Policy or Action

In 2025 to date, approximately 20% of the proposals voted on to date dealt with risks related to discrimination based on the exercise of free speech or religion. Slightly less than 10 proposals asked for reports on how a company “oversees risks related to discrimination against ad buyers and sellers based on their political or religious status or views,” alleging censorship “for expressing disfavored political and religious viewpoints.” Additionally, a small number of proposals requested a report on risks related to religious or other discrimination against employees, or discrimination against customers.

In 2024, proposals related to discrimination also constituted around 20% of the anti-ESG proposals subject to a shareholder vote. However, almost all of the 2024 proposals specifically asked for companies to issue reports on risks related to discrimination against individuals, customers and/or employees based on factors including religion, and/or whether this may impact individuals’ exercise of their civil rights or the company’s business. The 2025 proposals, detailed above, were more varied and used stronger language, including references to “censorship” of certain views. As yet, none of these proposals in either year have received more than approximately 2% shareholder support.

Proposals Relating to Climate-Based Risk

In 2025 to date, almost 20% of anti-ESG proposals opposed company responses to climate-based risks, such as requests for reports on costs, benefits and/or risks arising from voluntary environmental activities, such as carbon-reduction commitments, or requests to remove all GHG emissions reduction targets. The overwhelming majority of these proposals that have been voted on received less than 3% shareholder support.

In 2024, an almost equivalent percentage of anti-ESG proposals on which shareholders voted were related to climate-based risk, showing ongoing interest in this topic, perhaps especially in light of the SEC’s adoption of rules regarding the disclosure of climate-based risk.[1] However, the rules became subject to litigation almost immediately after adoption, and on February 11, 2025, then Acting SEC Chair Mark Uyeda publicly stated his request that the Eighth Circuit Court of Appeals postpone arguments in the case.[2] Subsequently, on March 27, 2025, the SEC voted to end its defense of the rules, such that it is difficult to predict whether the number of shareholder proposals focused on climate-based risk will remain constant in 2026.[3] Importantly, all but one of the 2024 proposals received approximately 3% support or less, in line with overall low support in 2025.

Proposals About Technology and Artificial Intelligence

In terms of technology-focused proposals, even anti-ESG proposals are not immune to the growing focus on artificial intelligence (“AI”). The same proposal, requesting a report assessing the risks posed to each company and the public due to the real or potential improper use of data in developing, training, and deploying AI offerings, as well as the steps taken to mitigate these risks, received high levels of shareholder support at several different companies, averaging around 10%. In 2024, anti-ESG proponents submitted a single identical proposal, receiving approximately 35% support, the highest of any anti-ESG proponent proposal that year. We will have to wait to see if the increasing frequency of AI-focused proposals, outside of the topics generally addressed by conservative proponents, continues in future years, but it seems clear from the relatively large shareholder support on which companies and investors will continue to focus.

Corporate Governance Proposals

In 2024, a small number of anti-ESG proponents submitted proposals related to corporate governance topics. Examples include a prohibition against directors simultaneously sitting on the boards of two or more other companies and two or more non-corporate organizations, and proposals mandating a separate chair of the board and chief executive officer. However, we did not find a significant number of corporate governance-related proposals from anti-ESG proponents in 2025, so it will be interesting to see what happens in 2026.

Key Takeaways

So far, the 2025 proxy season has demonstrated that, in spite of a seeming increase in public anti-ESG sentiment and anti-ESG shareholder proposals, support for anti-ESG measures remains low. Notwithstanding, anti-ESG proponents appear to be broadening their agendas—from familiar attacks on DEI initiatives and climate-related targets to newer demands addressing political or religious discrimination, cryptocurrency treasury strategies, artificial intelligence oversight and, to a lesser extent, traditional governance reforms—thereby compelling issuers to respond to an ever-wider array of proposals. Companies were more aggressive in seeking SEC no-action relief this year, and, overall, the Staff was more willing to grant it. However, roughly half of challenged proposals nevertheless survived.

The guidance in SLB 14M seems to have made it slightly easier for companies to exclude shareholder proposals that do not directly tie a significant policy issue to the company’s business; however, the Staff’s decision-making regarding no-action requests remains somewhat opaque. In light of this, boards and management teams should continue to refine their shareholder-engagement protocols, maintain clear rationales for ESG-related policies, and ensure that disclosure controls are calibrated to address both pro- and anti-ESG scrutiny, recognizing that while anti-ESG activism shows little sign of swaying the broader investor base, it will persist as a vocal and procedurally sophisticated force in the proxy landscape.

Distribution channels: Education

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release