The Evolving Landscape of DEI Shareholder Proposals

Shareholder engagement in diversity, equity & inclusion (DEI) is evolving in response to broader shifts in corporate governance, investor priorities, and political and legal scrutiny. This report examines recent trends in DEI-related shareholder proposals and early insights from the 2025 proxy season, including declining investor support for DEI initiatives, the rise—but limited success—of “anti-DEI” filings, and the implications for corporations.

Key Insights

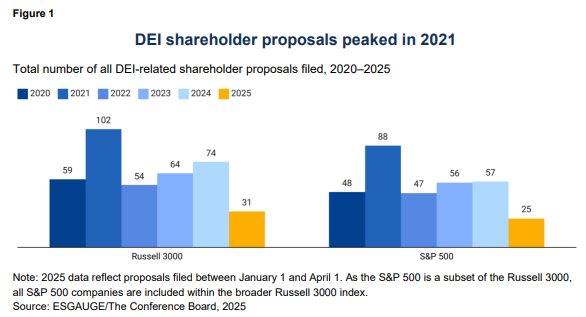

- DEI-related shareholder proposals peaked in 2021 but remain an important investor focus, with large-cap companies facing pressure to enhance disclosure and commitments.

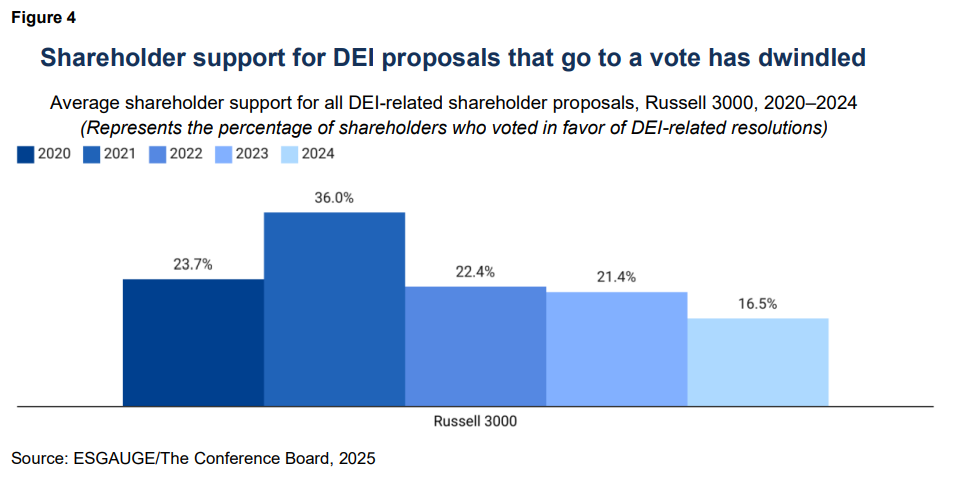

- Shareholder support for all DEI proposals (both pro- and anti-DEI) steadily declined since 2021 as improved corporate disclosures, investor fatigue, proxy advisor opposition, and heightened legal risks make negotiated withdrawals and majority approvals increasingly rare.

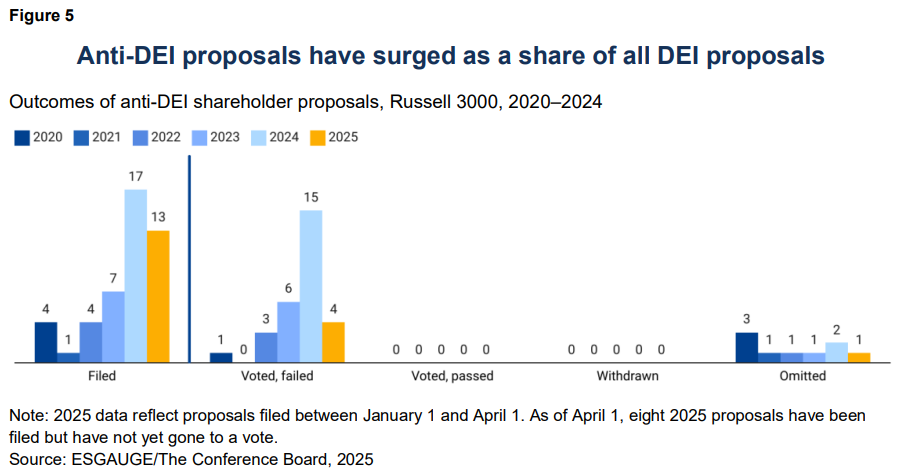

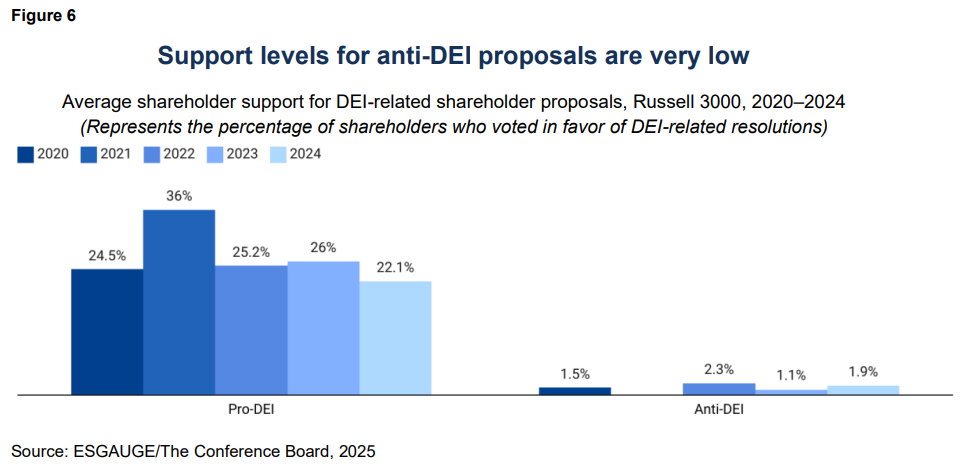

- Anti-DEI shareholder proposals surged as a share of all DEI-related filings since 2023, although support levels remain very low—averaging less than 2%—as proponents generally use the proposals as a tool to apply pressure rather than expect them to pass.

- The polarization of DEI proposals has persisted in the 2025 proxy season, with anti-DEI filings increasing but receiving little support; meanwhile, several large firms face competing proposals from both sides of the ideological spectrum.

Trends in DEI Shareholder Proposal Volume and Focus

DEI-related shareholder proposals consistently represent the majority of human capital management-related proposals, reflecting sustained stakeholder and investor interest. Proposal volume peaked in 2021 amid heightened investor and societal focus on racial and gender equality but has since moderated (Figure 1). More than 80% of DEI proposals have targeted S&P 500 companies, as activists prioritize large firms where engagement is more likely to drive governance changes and set industry benchmarks.

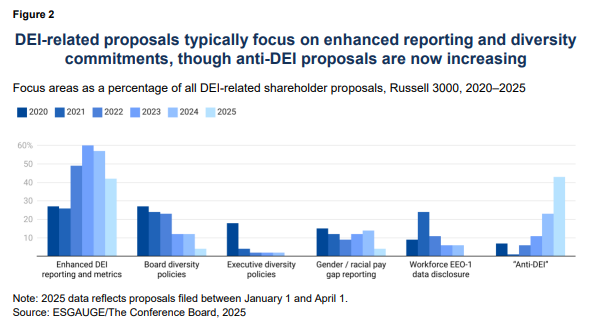

While the specific focus of DEI proposals has evolved in line with broader business and societal trends, the most common themes since 2020 include (Figure 2):

- Enhanced DEI reporting and metrics: Proposals seeking greater transparency in corporate DEI efforts, including disclosures on diversity in hiring, retention, and promotion.

- Board and executive diversity policies: Calls for commitments to include diverse candidates in board director appointments and senior executive hiring. While executive diversity proposals declined after 2020, board diversity remains a consistent focus.

- Pay gap disclosure: Proposals requesting disclosure of median and adjusted pay gaps by gender and race, citing links to recruitment, retention, and corporate reputation.

- Workforce EEO-1 (Employer Information Report) data disclosure: Requests for companies to publicly disclose EEO-1 workforce demographic data, which categorizes employees by race/ethnicity, sex, and job category. Companies already submit this data annually to the Equal Employment Opportunity Commission.

- Anti-DEI: Proposals questioning, challenging, or opposing DEI initiatives, including calls to assess legal risks or reconsider DEI programs and strategies. These proposals are clarified below and analyzed in further depth in this report.

|

Anti-DEI Shareholder Proposals

A growing number of shareholder proposals aim to question, limit, or oppose corporate DEI initiatives. While proponents frame them as promoting merit-based practices, their practical effect is to curtail or eliminate DEI initiatives. Referring to these as “anti-DEI” proposals, though imperfect, helps differentiate from proposals aimed at strengthening DEI practices. The volume of anti-DEI proposals has risen sharply, from 6% of all DEI-related proposals in 2022 to 23% in 2024, a trend continuing in 2025. Initially, these proposals focused on narrow issues, such as adding “viewpoint” and “ideology” to equal opportunity policies. After the Supreme Court’s 2023 decision striking down affirmative action in college admissions, 1 the focus shifted to assessing legal risks, with recent proposals calling for reports on potential reverse discrimination liability or advocating for abolishing DEI departments. Distinguishing between anti- and pro-DEI proposals can be challenging because both often request similar actions, such as audits and disclosures. Key differences include:

|

Shareholder Engagement on DEI

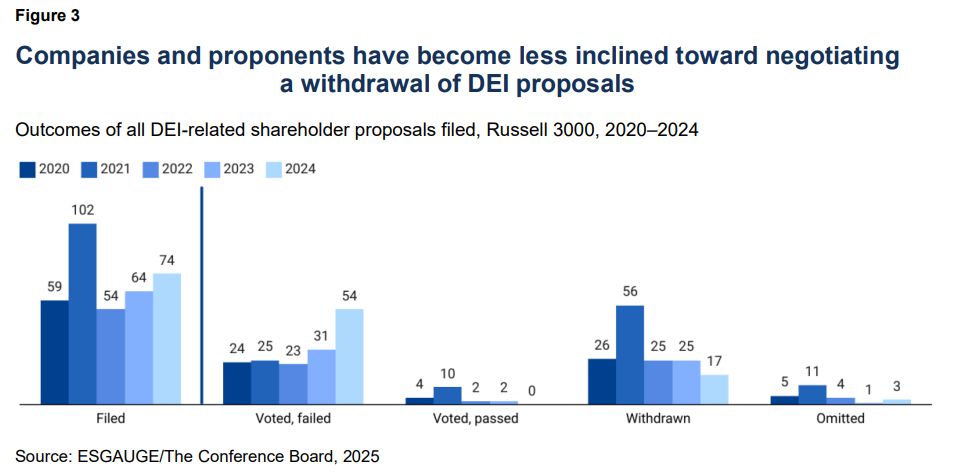

At the peak of DEI proposal activity in 2021, companies and proponents were more willing to engage, leading to negotiated withdrawals for over half of all proposals submitted at Russell 3000 companies, while about 10% of those that went to a vote passed. Since then, reaching agreements has become more difficult, particularly as some proponents’ requests have become more prescriptive or disruptive. The issuance by the Securities and Exchange Commission (SEC) of Staff Legal Bulletin 14L (SLB 14L) in November 2021 further constrained companies’ ability to exclude DEI proposals.2 By 2024, over 70% of DEI proposals went to a vote but none secured majority support (Figure 3).

Over the 2020–2024 period, certain themes and types of DEI-related proposals were more likely to garner support from shareholders, as well as be withdrawn or omitted:

- Most likely to be withdrawn: From 2020 to 2023, proposals on enhanced DEI reporting and board diversity commitments were frequently withdrawn, as companies engaged with investors to reach negotiated agreements. Withdrawals declined after 2023, with remaining withdrawals mainly related to board diversity and pay equity.

- Most likely to be omitted: From 2020 to 2022, workplace policy and racial equity audit proposals were sometimes omitted due to SEC challenges or being deemed too prescriptive. Omission rates declined significantly after 2021, following SEC guidance under SLB 14L.

- Most likely to pass: Proposals related to EEO-1 disclosure and pay equity were the most likely to pass from 2020 to 2023. Support peaked in 2021 and few proposals have passed since.

- Most likely to fail with reasonably high support (30–49%): Board diversity and racial equity audit proposals consistently received strong but insufficient shareholder backing. Some DEI-related reporting proposals also fell in this range.

- Most likely to fail with moderate support (10–29%): Broader DEI reporting requests, along with proposals related to hiring, promotion, and workplace policies, often failed due to limited investor consensus.

- Most likely to fail with low support (less than 10%): Highly prescriptive reporting proposals and company-specific DEI requests typically received little backing.

- Most likely to fail with very low support (less than 5%): Anti-DEI proposals consistently garnered the lowest levels of shareholder support, typically receiving only 1–3%, with none exceeding 5%.

For all DEI proposals that go to a vote (both pro- and anti-DEI), shareholder support levels have declined since peaking in 2021. This trend is not unique to DEI: as previously reported by The Conference Board, support has weakened across all areas of shareholder voting (in particular environmental and social issues) with the exception of corporate governance. Subdued shareholder support can be attributed to:

- Improvement in corporate practices: Targeted companies, particularly large-cap, now report EEO-1 data and board diversity metrics that made up the majority of DEI shareholder proposal requests, reducing the need for further shareholder action on concerns that have been addressed.

- Proposal fatigue: Key asset managers such as BlackRock, Vanguard, and State Street have become more selective in supporting DEI proposals, often citing improved corporate disclosures and concerns over proposal relevance or prescriptiveness.

- Guidance from leading proxy advisors: Since 2023, Institutional Shareholder Services and Glass Lewis have increasingly recommended against DEI proposals, typically citing redundancy (as many companies already disclose workforce diversity and board composition data) and overreach (as some proposals mandate specific racial or gender hiring targets, raising governance and legal concerns).

- Political and legal risks: The regulatory and legal landscape for DEI has shifted significantly since the Supreme Court’s 2023 ruling on affirmative action in college admissions, intensifying scrutiny of corporate diversity practices and increasing legal risks, particularly around race- and gender-based targets.

- Minimal support for anti-DEI issues: As noted above, anti-DEI proposals consistently receive very low shareholder support (below 5%), which has pulled down overall average support for DEI proposals. However, even when excluding these proposals from the analysis, average support for DEI initiatives has steadily declined since 2021.

The SEC’s recent rule changes on 13G eligibility are likely to further affect support for DEI and other shareholder proposals by limiting how companies engage with institutional investors.3 Stricter communication rules may hinder candid discussions on key issues, reducing institutional investors’ influence compared to activist shareholders and proxy advisors, who are not subject to the same restrictions. This makes thorough disclosure and transparency in proxy statements—including clear cost–benefit analyses of shareholder proposals—even more critical, as institutional investors may rely more heavily on public filings to guide their voting decisions.

Anti-DEI Proposals: Detailed Analysis

As the political and legal landscape for DEI has evolved in the US, the number of anti-DEI proposals has grown quickly, from only 7% of all DEI proposals in 2022 to 23% in 2024. This trend has accelerated in the 2025 proxy season, with approximately 40% of DEI proposals filed as of April 1 opposing DEI efforts. These proposals generally fall into four categories, with calls to abolish DEI programs and remove DEI from executive compensation gaining prominence:

- Legal and financial risks of DEI: Requests for audits or reports on whether corporate DEI programs create legal liability by discriminating based on race, sex, or other protected categories, such as by exposing companies to potential reverse discrimination lawsuits.

- Executive compensation and DEI: Proposals call for removing DEI-related performance metrics from executive pay structures, arguing that such goals introduce bias and detract from traditional performance-based compensation.

- Reconsider or abolish DEI programs: Proposals seeking to scale back or eliminate DEI programs, policies, and departments, questioning their necessity, effectiveness, or legality. These proposals have grown in 2025.

- “Viewpoint diversity” and ideological neutrality: Requests to include political ideology and viewpoint as protected characteristics in equal employment opportunity policies to prevent ideological bias or exclusion of employees with dissenting views.

Anti-DEI shareholder proposals have drawn increasing media and public attention, particularly amid heightened legal scrutiny under the new administration. The shifting regulatory landscape has prompted many companies to recalibrate their DEI policies and messaging. However, despite their visibility, these proposals continue to receive minimal shareholder support—less than 2% on average in 2024. This trend has continued in 2025, ranging between 0.8% and 2.3% across the four votes held as of March 20, 2025.

Institutional investors and proxy advisors consistently oppose these resolutions, viewing them as misaligned with corporate governance best practices and investor priorities. Companies, in turn, have largely recommended voting against them. The proposals also originate from a small group of activists rather than mainstream investor coalitions, further limiting their appeal. However, passage is rarely the primary objective. Instead, these proposals function as strategic tools to exert influence through:

- Regulatory and legal pressure: Filers seek to elicit public disclosures and corporate responses that can be used to support litigation, regulatory challenges, or political action against DEI programs.

- Media and political leverage: Even with low shareholder backing, these proposals fuel headlines, pressure campaigns, and generate talking points about DEI in corporate America.

- Shaping corporate behavior: The objective may also be deterrence—raising legal risk concerns that may prompt some companies to scale back or de-emphasize DEI commitments.

Navigating DEI Pressures in the 2025 Proxy Season

Early trends in the 2025 proxy season indicate that DEI remains a central issue in shareholder proposals related to human capital management. The nature of DEI-related proposals also continues to evolve, reflecting broader regulatory and political shifts under the new administration.

While anti-DEI proposals continue to attract media attention, the trend of very low shareholder support has continued. At the same time, some high-profile companies have faced multiple DEIrelated proposals from opposing perspectives, underscoring the complexity of balancing investor expectations, regulatory scrutiny, and corporate commitments.

John Deere: Parsing Divergent DEI PressuresDeere & Co.’s 2025 proxy season illustrates the complexities of managing DEI-related shareholder proposals amid shifting investor priorities, political scrutiny, and evolving corporate strategies. At the firm’s annual meeting on February 26, John Deere faced five shareholder proposals directly or indirectly related to DEI from different perspectives. The various outcomes highlight that while anti-DEI proposals continue to receive minimal support, pro-DEI proposals can gain meaningful traction—or even lead to engagement and withdrawal. This underscores the importance of parsing proposal language, as subtle differences in framing and intent can result in markedly different outcomes, from minimal support to negotiated settlements. Pro-DEI-related proposals at John Deere in 2025

Anti-DEI-related proposals at John Deere in 2025

|

The SEC’s recent issuance of Staff Legal Bulletin 14M (SLB 14M) may further shape proxy season dynamics, potentially reducing the number of proposals that reach the vote stage.4 Specifically, SLB 14M refines the SEC’s approach to determining when a proposal can be excluded under the ordinary business and micromanagement exceptions, which will likely lead to companies having stronger grounds to challenge ESG and DEI-related proposals. Navigating this landscape thoughtfully will be essential for managing DEI-related challenges while maintaining strong investor relations.

This article is based on corporate disclosure data from The Conference Board

Distribution channels: Education

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release