Hays Central Appraisal District 2025 Value Increases

O'Connor discusses the Hays Central Appraisal District value increases in tax assessments for 2025.

AUSTIN, TX, UNITED STATES, April 29, 2025 /EINPresswire.com/ -- In 2025, the Hays Central Appraisal District saw a 5.0% increase in the assessed value of single-family homes. Commercial property values show modest growth of 4.4% in 2025. These property increases in market value account for both existing properties and new construction. Hays County property owners will experience high taxes in 2025, but they have the opportunity to protest those high taxes for a fair reduction.

Hays County Home Tax Assessments Increase by 5.0%

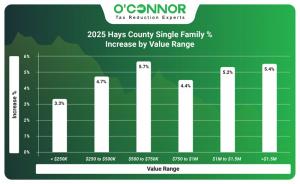

An analysis of property tax assessments by value range in Hays County shows no clear trend. Each category of houses in Hays County saw increases this year. Notably, property tax assessments surged highest in Hays County for homes valued between $500,000 to $750,000, experiencing a 5.7% uptick in market value. The smallest increase was observed in the value category for residences priced at $250k or less, a 3.3% increase. Homes worth between $1 million and $1.5 million saw a 5.2% increase and houses worth $1.5 million and more increased by 5.4.

In Hays County, the total property value increased by 1.6% in 2024, followed by a more substantial rise of 5.0% in 2025. There is a clear trend showing that larger homes tend to see greater value increases. Homes exceeding 8,000 square feet experienced a notable jump of 11.7% in 2025, up from 9.4% the previous year. In comparison, mid-sized homes between 2,000 and 3,999 square feet saw a 5.3% increase, while properties ranging from 6,000 to 7,999 square feet recorded a 6.5% rise.

During the 2025 property tax reappraisals conducted by the Hays CAD, it became clear that properties built in 2021 or later experienced the largest increase in assessed value, rising by 23.9%. In contrast, properties built before 1960, which saw the highest assessment increase in 2024, received one of the lowest increases in 2025 at just 2.6%.

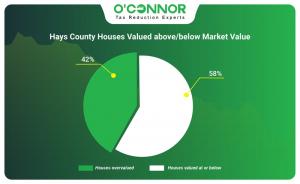

The analysis relies on comparing the 2024 sales price of a home with its 2025 property tax reassessment value. In 2025, Hays CAD overvalued 42% of homes in Hays County, compared to 56% in 2025. Based on January 2025 sales, houses that are valued at or below market value is 58%. The 2024 notice market value for overvalued homes is $1.446 billion and for homes valued at or below is $1.936 billion.

Hays County Commercial Property Taxes Increases in 2025

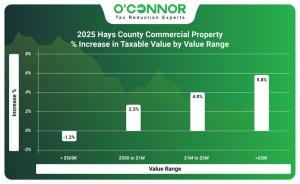

Most commercial property assessment categories and price ranges in Hays County saw increases during the 2025 tax year. There is a consistent correlation between the more expensive the home, the higher the increase. Particularly noteworthy was the 5.8% rise for houses priced at $5 million and above, as well as the 4.0% increase for properties valued between $1 million to $5 million. These two categories stood out as having the most significant gains compared to all other assessed value ranges.

Amidst the 2025 property tax assessments, several commercial property owners in Hays County opted to protest their taxes. Notably, apartment properties had the biggest increase of 24.3%. Hotel building values increased by 5.6% and warehouses by 4.6%.

Except for one range of years of built, Hays CAD noticed very minimal increases in commercial property assessments for 2025. The most significant increase in value was observed in properties constructed in 2021 and later, with assessments increasing by 35%. The lowest value increase was seen in properties built between 1961 to 1980 with 1.2%.

Hays CAD Commercial Valuations Increased by 4.4% compared to WSJ Article

Green Street Real Estate, a leading Wall Street firm, has released research that highlights a sharp contrast with the 2025 commercial property tax reassessment by Hays CAD. While the district reports a 4.4% increase in commercial property values over the past year, Green Street’s latest analysis indicates a substantial 21% decline in U.S. property values since March 2022.

Hays County Apartment Property Values Soared By 20%

Property tax assessments for apartment buildings in Hays County surged by approximately 24.3% in 2025, compared to 20% in 2024. In 2024, apartment buildings constructed between 1961 and 1980 experienced a 28% increase; however, in 2025 it resulted in -0.1%. For 2025, data indicates that the highest increase in value goes to buildings constructed in 2021 and later with a 82.1% rise.

Property tax assessments for the two separate kinds of apartment buildings in Hays County increased by a combined 24.3% in 2025. Garden properties jumped from 17% in 2024 to 29.3% in 2025. Unlike the 23.4% increase in 2024 for apartment buildings, in 2025 the value declined to -10.2%.

Increase in Assessments for Hays County Office Buildings 2025

The overall increase in property tax assessments for office buildings across all year-built categories was approximately 3.3%, a drop from the 8.6% recorded in 2024. For buildings constructed between 1981 and 2000, the Hays CAD reported a 5.9% increase, also below the 15.5% increase seen in 2024. For 2025, office buildings built in 2021 or later experienced the highest jump, with a 12.3% increase. In contrast, the smallest increase was observed in buildings constructed between 2001 and 2020.

Property tax assessments rose significantly for low rise office buildings in Hays County in 2025. Low rise buildings had the highest level of increase of 9.0%, followed by high rise office buildings of 1.9% increase.

Hays CAD Retail Tax Assessments Up by 2.3%

Retail property values in Hays County have surged by an average of 2.3% in 2025, lower than the 8.2% for 2024. Retail buildings constructed in 2021 and later had the greatest growth, marking a 12.4% increase. Between 1961 to 1980, retail property construction resulted in a 3.9% tax assessment increase. There was a 0% increase for retail property built before 1960.

It’s worth noting that the retail property type does not include any subtypes. In Hays County, single-tenant retail buildings experienced an 8.6% increase in property taxes in 2024. However, that rate moderated to a 2.3% increase in 2025. The 2024 final market value was $894 million and rose to $915 million in 2025.

Hays CAD Warehouse Tax Assessments Increased by 4.6%

In the transition from 2024 to 2025, property tax assessments for warehouse buildings in Hays County saw a notable increase of 4.6%. Particularly, the category of warehouse buildings constructed between 1961 to 1980, experienced a 5.3% gain. Warehouse buildings constructed prior to 1960 had the lowest assessed value increase at 0.3%. Additionally, warehouse buildings built between 2021 and later had a growth of 3.7% increase.

The warehouse property type does not include any subtypes. Market values for warehouse facilities per Hays CAD went up 4.6% overall, from $1,031 billion to $1,078 billion.

Hays County Assessments Reveal Modest Growth Amidst Decline in Austin Metro Single-Family Property Values

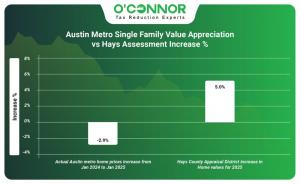

According to reports, during the reassessment of Hays County property taxes in 2025, Hays CAD saw a 5.0% increase in value, higher than the 1.6% increase in 2024. The Austin Board of Realtors reported that the assessed change in property values in the Austin Metro area from January 2024 to January 2025 was a 2.9% decline.

Hays Central Appraisal District 2025 Property Tax Assessment Summery

Property owners in Hays County are dealing with increases in residential property and commercial property prices. Further, Hays County is seeing more significant documented expansion in comparison to the Austin metropolitan area. In 2025, residential property tax assessment values averaged 5.0% increase and averaged 4.4% increase for commercial property. The Austin metro home prices for the past year declined 2.9%, but Hays CAD saw an increase of 5.0%.

About O'Connor:

O’Connor is one of the largest property tax consulting firms, representing 185,000 clients in 49 states and Canada, handling about 295,000 protests in 2024, with residential property tax reduction services in Texas, Illinois, Georgia, and New York. O’Connor’s possesses the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs a team of 1,000 worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ +1 713-375-4128

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Distribution channels: Banking, Finance & Investment Industry, Building & Construction Industry, Business & Economy, Consumer Goods, Real Estate & Property Management

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release