The Evolving Role of the CHRO in the Boardroom

The role of the chief human resources officer (CHRO) in corporate management and governance is expanding as companies increasingly recognize the need for human capital expertise in business performance, risk management, and value creation. As the next generation of CHROs emerges, this report examines how CHRO-board engagement is evolving at publicly traded companies in the US and Europe.

Key Insights

- The CHRO’s role is expanding beyond traditional transactional HR specialist to encompass greater responsibility for corporate governance, as boards and senior management place greater emphasis on human capital strategies to meet evolving business, regulatory, and investor expectations.

- Boards and CEOs expect CHROs to act as enterprise leaders who align human capital strategy with financial, operational, and risk priorities and drive workforce strategy, succession planning, mergers & acquisitions, and business transformation in collaboration with the wider C-Suite.

- Four key derailers can undermine CHROs’ board engagement and strategic impact: 1) perceptions of HR as solely administrative, 2) succession planning friction, 3) CEO-imposed access limits, and 4) limited commercial and financial acumen. Addressing these challenges requires clearer board designation of responsibilities, more structured processes, and greater recognition of human capital’s strategic role.

- Boards and CEOs can empower CHROs by enhancing board access, recognizing and reinforcing CHROs’ neutrality in executive and operational matters, and fostering a trusted partnership for candid workforce risk insights that inform high-level decision-making.

- CHROs’ board engagement will likely grow as generational workforce shifts, AI transformation, and sustained regulatory uncertainty underscore human capital management as a core governance issue. This expanded engagement will require CHRO leadership in talent strategy, workforce risk management, and AI oversight.

The Changing CHRO Landscape

The role of the CHRO in the boardroom is undergoing a structural evolution. Once defined primarily by administrative HR expertise, the CHRO position is now increasingly expected to function as an enterprise leadership role—engaging deeply in business strategy, risk oversight, organizational transformation, and governance.

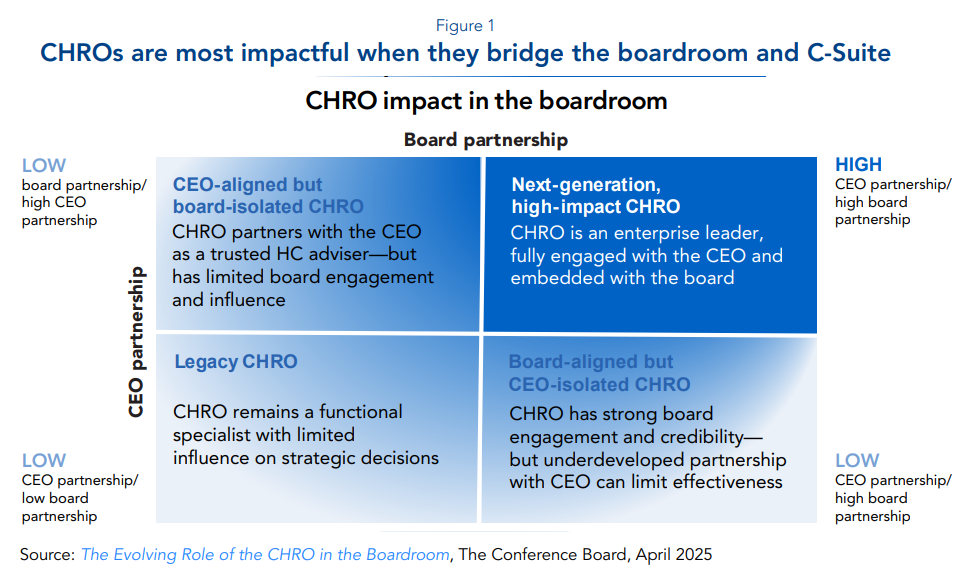

To support companies and their boards in this transition, the framework in Figure 1 categorizes CHRO boardroom impact along two dimensions: the strength of the CHRO’s partnership with the CEO and the depth of the CHRO’s engagement with the board. Sophisticated and business-savvy CHROs who are highly effective in both areas are “nextgeneration, high-impact CHROs”—fully embedded in the C-Suite and the boardroom and positioned to shape enterprise strategy, advise on governance risks, and guide long-term talent and succession planning. By contrast, CHROs with limited engagement on one or both axes remain constrained in their influence, whether isolated from board deliberations or underleveraged by the CEO.

Corporate Boards at Public CompaniesCorporate boards oversee a company’s strategy, risk management, and financial performance while ensuring that management is acting in the best interests of shareholders. They typically include executive directors such as the CEO and chief financial officer (CFO) (inside directors), as well as independent nonexecutive directors who provide oversight (outside directors). In the US, the board chair may be independent or also serve as CEO, while European governance codes generally mandate separation of these roles. Board structures vary by region. Supervisory boards, common in most European countries, follow a two-tier system, with a fully independent supervisory board overseeing strategy and executive appointments while a separate management board handles day-to-day operations. Unitary boards, found in most other markets including the US, integrate executives and independent directors on a single board, with the latter providing oversight and checks on management. Boards delegate key responsibilities to specialized committees, though structures vary by company and jurisdiction. Core committees typically include the audit committee, overseeing financial reporting and controls; the compensation committee, setting executive pay and incentives; and the nominating/governance committee, managing board composition, governance policies, and director nominations. |

The CHRO Role Has Evolved at Many Public Companies

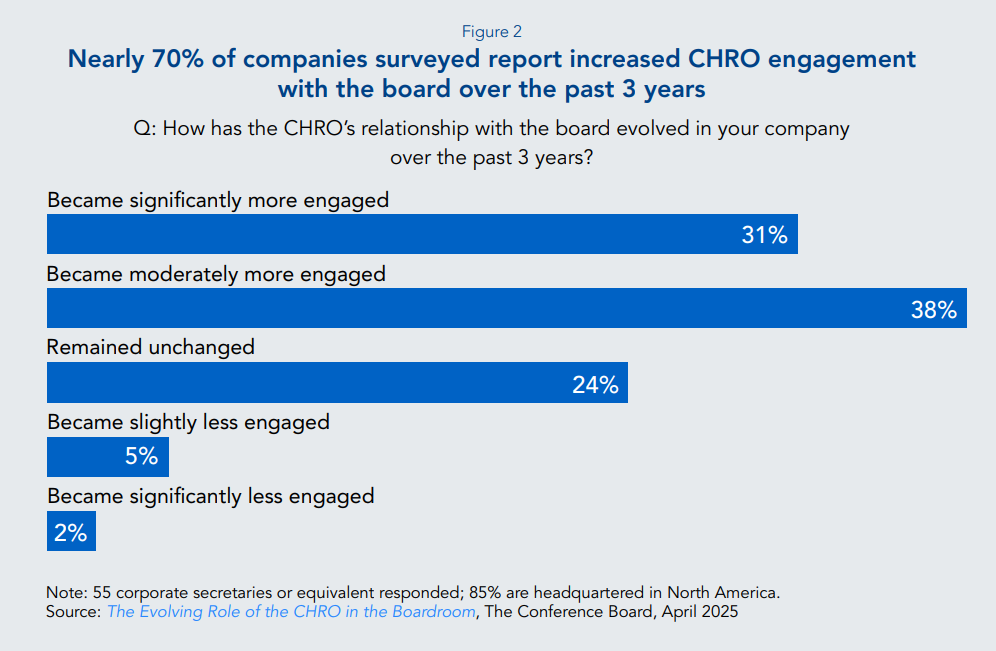

Once head of a primarily operational HR function, the CHRO now exerts greater influence in corporate governance and strategic decision-making and is significantly more engaged with the board at many companies (Figure 2). A pivotal moment in this shift was the COVID-19 pandemic, which forced companies to rethink workforce management, employee well-being, and organizational resilience. The crisis accelerated digital collaboration, reshaped workplace flexibility, and heightened focus on employee mental health.

Beyond the pandemic, longer-term economic and business shifts have also steadily elevated the CHRO’s role and visibility by making workforce strategy, leadership development, and mitigation of human capital risk even more central to business success. Key drivers have included the shift to a knowledge and services economy; a fast-aging population in many large economies; rapid technological change; globalization and increasingly complex talent markets; heightened investor and regulatory scrutiny of human capital management; and evolving employee expectations. CEOs and board chairs interviewed by The Conference Board consistently emphasized that as human capital issues have grown in perceived importance, they expect CHROs to work even more closely with their C-Suite peers to shape workforce strategy, drive engagement, advance corporate culture, and strengthen talent retention.

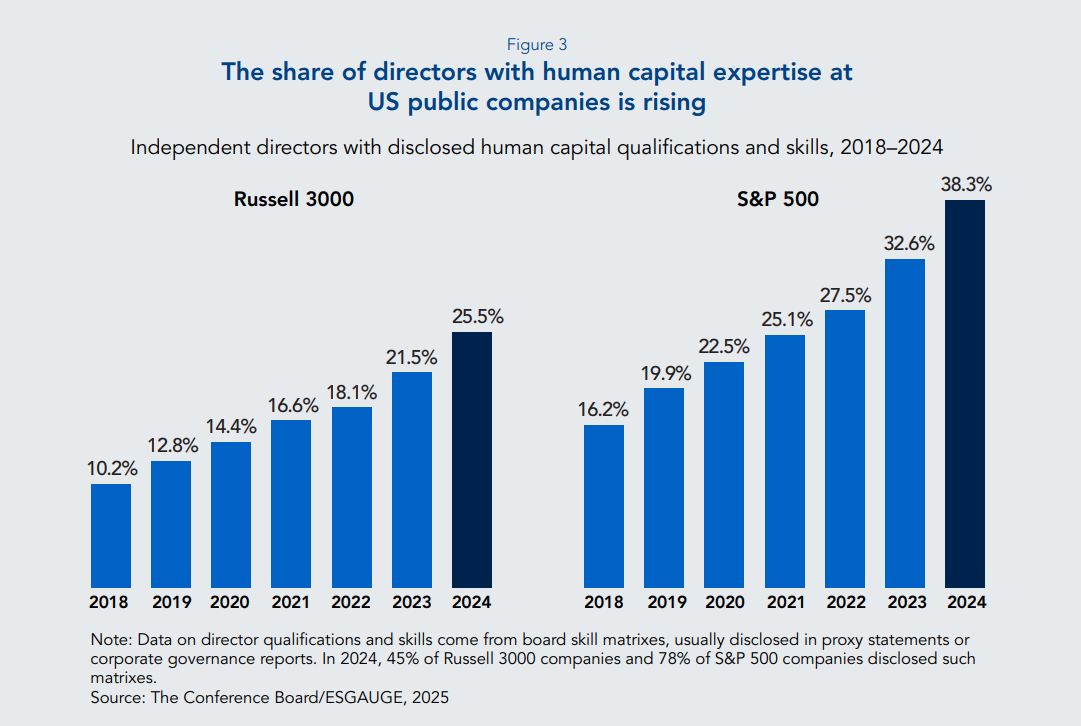

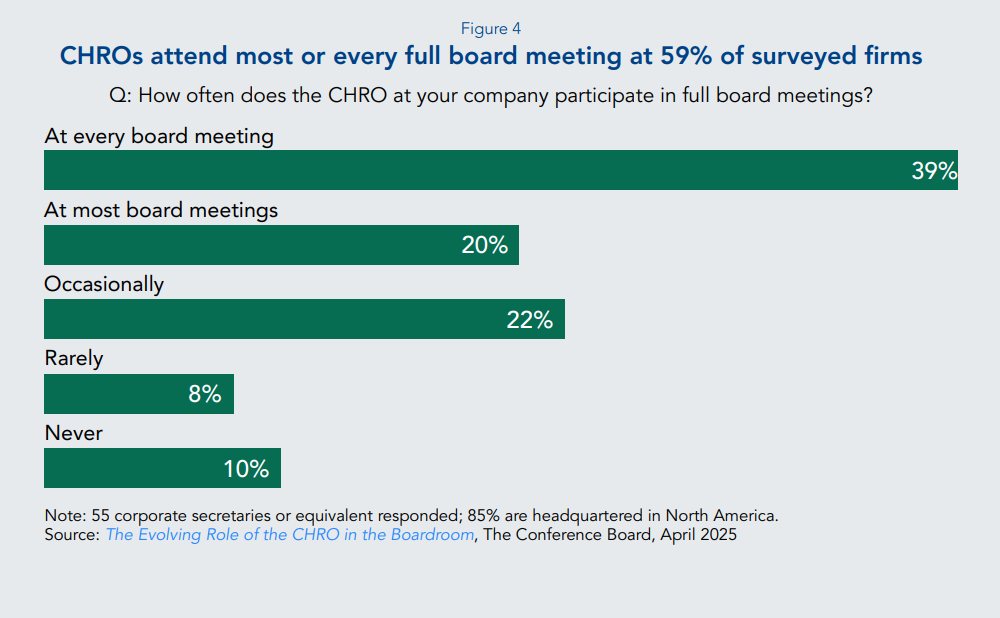

These drivers and shifts have also influenced an evolution in board composition, with a growing focus on appointing independent directors with expertise or backgrounds relating to human capital (Figure 3). This in turn has shaped a more receptive environment for integrating human capital considerations into strategic discussions, with CHROs playing a more active role in corporate governance and regularly engaging in board meetings and committees (Figure 4).

CEO and Board Expectations for CHROs: From Functional Specialists to Enterprise Leaders

The strategic role of the CHRO

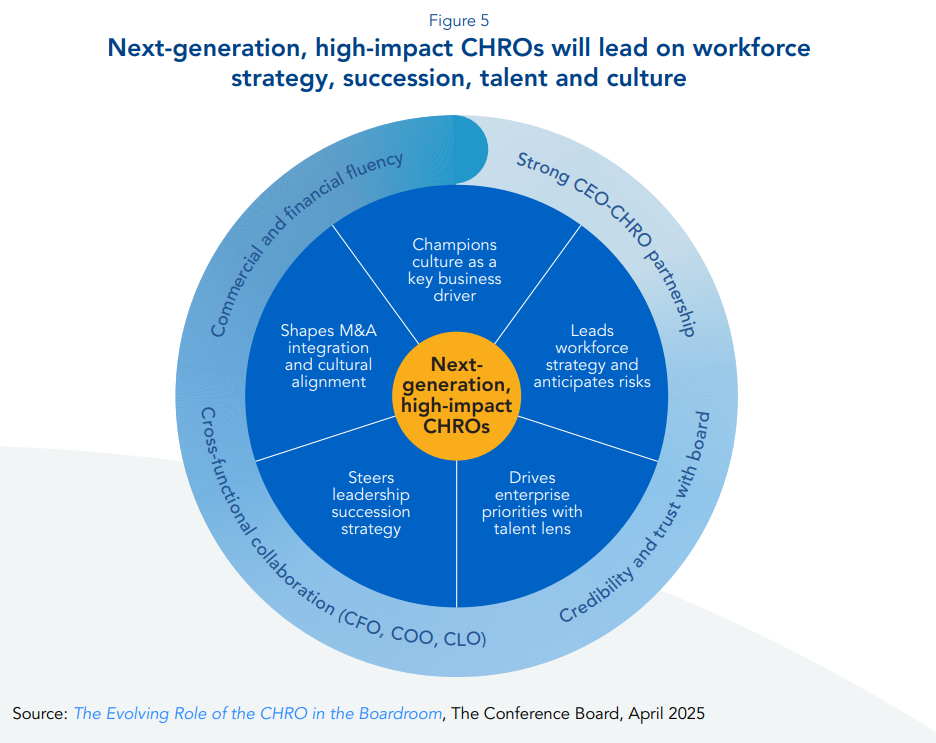

Interviews with CEOs and board members in the US and Europe reveal a clear expectation for CHROs to move beyond a traditional HR focus and take on the role of strategic enterprise leaders who drive business success with deep commercial insight and a strong understanding of organizational goals (Figure 5). Key expectations include:

- Business and financial strategy: Boards expect CHROs to be capable of linking workforce investments to shareholder value. One board member and CEO noted, “HR leaders who speak the language of finance and operations are far more valuable in the boardroom.”

- Workforce and labor market strategy: CHROs must ensure talent acquisition, retention, and development directly align with productivity, innovation, and digital transformation strategies. They are also expected to proactively adapt talent strategies to stay ahead of emerging challenges—ranging from wage inflation to skill shortages—and seize opportunities. As one former CEO and board member noted, “The best CHROs don’t just react to labor market shifts; they anticipate them and prepare the business accordingly.”

- Operational efficiency: Boards expect CHROs to leverage analytics to optimize head count, determine where to integrate automation, and drive productivity. This includes providing data-driven insights on workforce productivity, turnover risks, leadership pipeline strength, and future skills gaps.

- CEO and leadership succession planning: CHROs are expected to lead talent development efforts that go beyond identifying successors to actively building a talent pipeline and preparing leaders for advancement. “Boards want CHROs to do more than provide a list of names—they want a long-term succession plan that ensures business continuity,” noted one board director.

- Support for mergers & acquisitions and growth strategy: As one CEO observed, “If we’re acquiring a company, I need to know within 30 days what the cultural and talent risks are.” CHROs play an important role in assessing these risks in acquisitions, to ensure leadership alignment and mitigate disruptions.

Deepening CHRO integration as part of the C-Suite

The CHRO is most effective when collaborating as an equal within the leadership team, especially with the CEO, CFO, chief operating officer (COO), and chief legal officer (CLO). Boards increasingly expect CHROs to:

- Advise the CEO as a trusted partner on strategic issues: As one CEO noted, “My CHRO is my closest advisor on the things that can make or break this company—leadership, culture, and talent.” CEOs also increasingly rely on CHROs for confidential guidance on crisis management, reputation, and executive performance.

- Partner with the CFO: Collaborating with finance on aligning compensation structures, incentives, and workforce investments with business and financial objectives can elevate CHROs in the boardroom. As one CEO and chair noted, “The best CHROs will feel very comfortable speaking about the financial impact of human capital or even weighing in on an enterprise resource planning conversion.”

- Work with the COO: Together, CHROs and COOs can ensure workforce strategy aligns with operational execution, particularly in areas like productivity, organizational design, and digital transformation.

- Collaborate with the CLO: The CHRO should work with the CLO or equivalent to mitigate risk in areas such as AI governance, employment law, and union negotiations. As one board member put it, “Today’s CHRO must be as fluent in legal and compliance risks as they are in talent strategy.”

Maximizing the CHRO’s Value to the Company: Practical Recommendations for CHROs, Board Directors, and CEOs

CHROs: Strategies to deepen influence and impact

The CHROs we interviewed are keenly aware that their role on boards is evolving rapidly. CHROs can further enhance their influence and meet CEO and board expectations by:

- Building professional credibility and trust with the board. Before CHROs can be viewed as strategic partners, they must establish the board’s trust in their expertise. “You will be tested when you are first in the role of CHRO or when a new chair is nominated,” noted one CHRO with experience working under three different board chairs. “The chair might have a checklist of what they’ve seen done well in other companies…I had one or two sessions with the new chair where it was clear he was trying to gauge whether I knew my stuff as CHRO.”

- Demonstrating business acumen and financial expertise. CHROs are increasingly expected to engage in financial, operational, and strategic discussions. “CHROs are thought of as a qualitative kind of role and skill set, but increasingly, they need to be a financial, operations, and strategic expert,” said one CEO. To build capacity, CHROs should engage with the CFO regularly, develop a strong understanding of key financial metrics, and seek exposure to broader financial and operational decision-making.

- Fostering informal and ongoing engagement with board members. “That way, you can nurture a more collaborative environment than just going in front of an advisory board as if it were a jury,” noted one CHRO. Several CHROs emphasized the value of “keeping chairs of key board committees close” via regular one-on-one discussions to “anticipate concerns, gather insights, and fine-tune proposals.” In cases where the CHRO has a mature relationship with the board, they can use their influence to build close and collaborative relations between the board and the wider executive management team.

- Steering board discussions on human capital. CHROs are expected to provide strategic insights on workforce and labor issues that impact company performance, talent attraction, and reputation. This includes taking deep dives into leadership development, employee engagement, and employer branding, as well as equipping directors with workforce and labor intelligence through expert briefings, market trend analyses, and participation in leadership off-sites. One CHRO interviewee recently presented a three-year organizational transformation plan to the board focused on three priorities: culture, leadership, and strategic capability planning.

- Cultivating strategic alignment with the CEO before engaging the board. While CHROs and CEOs will not always agree on elements of the people strategy, CHROs must decide when to align with the CEO’s position and when to present an independent perspective to the board. Interviewees emphasized that the CFO should also be involved in these discussions, as “the CEO, CFO, and CHRO effectively control strategy, so they need to be a tightly knit team.” One CHRO described the ideal dynamic as “constructive but critical conversations…on how to evolve the organization and each leadership role. If you can receive from the board further insights and support, even mentoring, then you have the perfect match.”

Board directors: Actions to support CHROs to maximize influence and impact

Boards are crucial in legitimizing CHROs and empowering them as strategic partners, although CHROs can only maximize their influence in board discussions when directors clearly define their expectations and provide necessary support. Furthermore, while governance structures vary across the US and Europe, it is often the CEO’s preferences that dictate the CHRO’s access to the board. Directors should therefore actively set and reinforce expectations with both the CHRO and the CEO to ensure human capital remains a strategic priority, including:

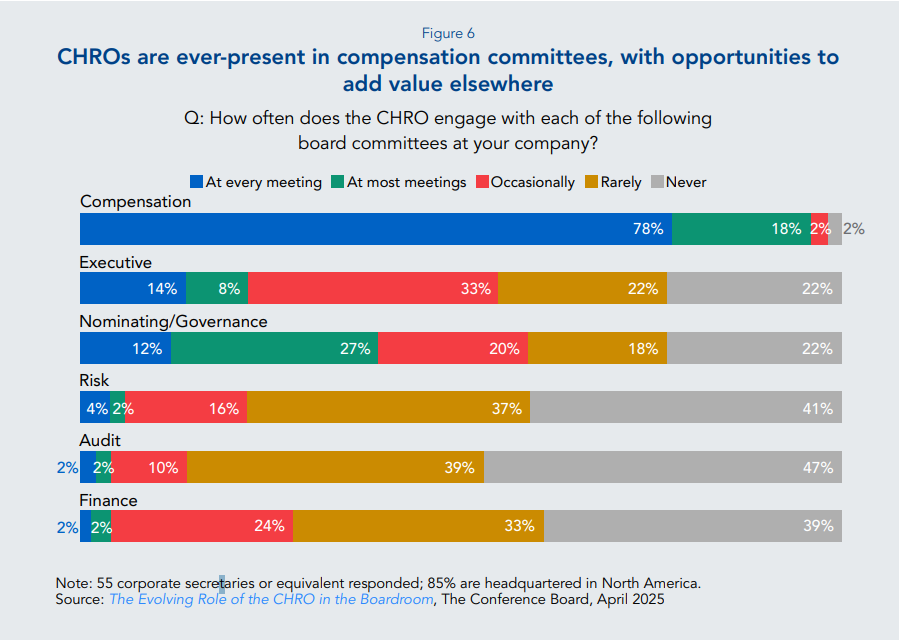

- Establishing a direct board-CHRO relationship. Boards should clearly communicate to the CEO that direct engagement with the CHRO is important. CHROs interviewed emphasized that “the board provides legitimacy to the CHRO” and can counteract “hidden hierarchies” within the C-Suite that may diminish the CHRO’s voice or influence. While the compensation committee is the primary forum for CHRO input and leadership (see Figure 6), boards should consider expanding CHRO access to the nominating/governance, audit, and risk committees to strengthen oversight of human capital strategy.

- Enhancing the depth and quality of board discussions on human capital strategy. Boards should move beyond routine talent updates to regularly include strategic human capital topics such as building corporate culture and risk mitigation on the agenda. As one CHRO noted, “Conversations between the board and the CHRO often fall short. The board should be asking searching questions about leadership, skills, culture—let the CHRO bring value.”

- Supporting the CHRO in executive compensation and succession planning discussions. These sensitive topics can place the CHRO in a complex and delicate position between the board, CEO, and other executives. As one CHRO noted, “You’re in a tricky position and you need to remain neutral. You need allies, and that has to be with the supervisory board, especially the nomination committee, which is the ultimate decision-maker.” Boards should protect the CHRO’s role and reinforce the CHRO’s neutrality and strategic insight.

CEOs: Building a trusted and effective relationship with the CHRO

The CHRO’s influence and impact are legitimized and strengthened by the support of the CEO. While reporting to the CEO, the CHRO also has a duty to the board to provide independent insights and alternative perspectives. Navigating this dual role successfully requires a strong, trusting partnership that CEOs can cultivate through:

- Championing the people strategy to the board. A CEO’s visible commitment to workforce strategy elevates human capital as a priority in board discussions. As one CHRO noted, “My CEO is the first in line to connect with the board on people and culture issues.” CHROs play a critical advisory role by flagging workforce-related risks and opportunities for the CEO, including talent attraction, corporate reputation, diversity and inclusion, and workforce upskilling. “My CEO is always asking, ‘What’s your opinion on that; what topics are material; can you flag risks for me?’” observed one CHRO.

- Building trust through open and honest dialogue. The CHRO’s value to the CEO comes from the former’s ability to act as the “voice of the business,” providing unfiltered feedback on organizational health, leadership effectiveness, and workforce sentiment. One CHRO emphasized, “The CHRO must maintain neutrality and honesty, providing transparent information to the CEO, even when this involves difficult or unpopular views.” CEOs can support this by fostering a culture of transparency where the CHRO can provide candid insights and challenge assumptions and groupthink without fear of repercussions.

- Empowering the CHRO as a genuine peer in the C-Suite. CEOs should ensure that the CHRO is fully integrated into core strategic decision-making, treating them as a peer on par with business unit leaders and the CFO. This means involving the CHRO not just in discussions about workforce strategy but also in broader enterprise decisions where human capital considerations are critical. As one CHRO noted, “the CEO, CFO, and CHRO effectively control strategy, so they need to be a tightly knit team.” Ensuring that the CHRO has the same level of access to the board as other key executives also strengthens their ability to provide independent insights and challenge assumptions. One CHRO described the ideal dynamic as “constructive but critical conversations…on how to evolve the organization and each leadership role.”

Common Derailers for CHROs in Board Engagement

Our research interviews with HR and company leaders highlight four key structural and organizational challenges that can limit CHRO impact in the boardroom:

- Boards that undervalue CHRO and human capital expertise: Some directors continue to view the CHRO role as primarily operational or administrative, limiting their influence on strategic discussions. This perception has diminished at many firms as the CHRO has taken on an enhanced role, and boards have added more directors with human capital expertise (Figure 3). Notably, the appointment of former CHROs to US public company boards has nearly doubled in recent years, rising from 0.6% of newly appointed directors in 2020 to 1.4% in the Russell 3000 and 0.6% to 1.1% in the S&P 500 in 2024.

- Friction over CEO succession planning: CEO succession planning is often a source of tension, particularly when the CEO also serves as board chair. Common challenges include unclear board decision-making authority over succession, disagreements between the CEO and the board, and failure to start planning early enough. Boards can mitigate these conflicts by clearly defining their role and responsibilities in succession planning, initiating discussions early, ensuring private board-CHRO conversations on succession, and formalizing a structured, documented process. As one CHRO explained, CEO succession planning “has got to be the primary responsibility of the board,” and if the board does not make it clear that “[succession planning] is the board’s responsibility, not the CEO’s, then you’ve got a disconnect.”

- CEOs who limit the CHRO’s interactions with the board: Some CEOs restrict CHROboard engagement by controlling when and how CHROs can contribute. As one CHRO noted, “There are CEOs that don’t include their leadership team in the boardroom [and] that carefully manage interactions. Everything needs to come through him or her.” A more nuanced challenge arises when CEOs support CHRO-board engagement but also expect insight into those conversations. Transparency can be valuable—one CHRO noted that the CEO wanted “no surprises” regarding board discussions, while another described it as a courtesy to inform the CEO of discussion topics, even if specifics are not shared. However, this expectation can become a constraint if the CEO uses it to shape or limit what the CHRO feels comfortable discussing with the board. Ultimately, the appropriate level of transparency depends on the CHRO, CEO, and board, but it remains a delicate balance.

- Limited commercial and financial acumen: While human capital leaders excel in talent strategy and culture, some may struggle to demonstrate fluency in key business drivers— profit & loss statement management, capital allocation, innovation, risk assessment, and operational execution—that boards prioritize. Those who bridge this gap by developing stronger business acumen and aligning workforce strategies with enterprise performance are far better positioned for board influence and leadership beyond HR. As we heard from one CEO and board chair, “Most CHROs are still traditional HR people…We need HR people to be true business partners, and in order to do that, they have to have different backgrounds…We try to make sure that they speak at the table like a businessperson who has a technical expertise in HR.”

Future Opportunities for Enhanced CHRO-Board Engagement

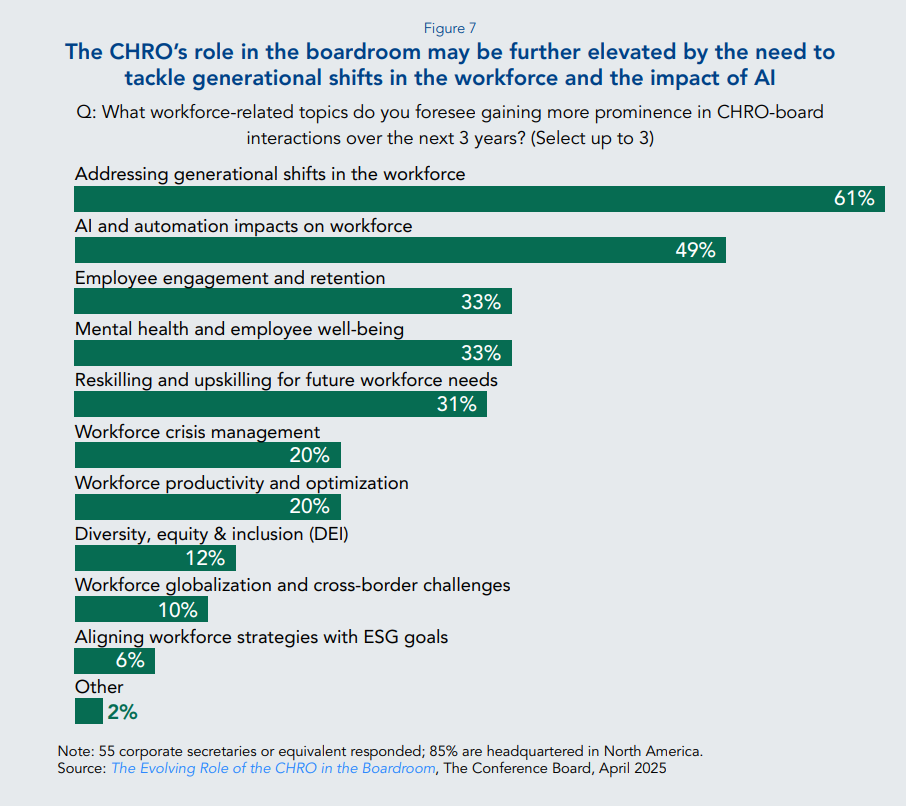

The CHRO’s role in corporate governance will likely further expand as societal and technological disruptions reshape workforce strategy (see Figure 7). Notably, 66% of corporate secretaries surveyed expect CHROs to become moderately or significantly more engaged with their board over the next three years, while only 2% anticipate any decline. Three key forces are driving this shift:

- Generational workforce shifts: As Gen Z and younger millennials reshape workplace expectations, CHROs must manage evolving demands for career development, flexibility, and corporate values. As one board director noted, “The workforce is changing, and companies that fail to adjust to new employee expectations will struggle to compete for top talent. The CHRO is at the center of that transformation.” European firms, which have structured worker councils, may address these shifts differently than US companies, where engagement is more individually driven.

- AI and automation’s business and workforce impact: As AI adoption accelerates, CHROs have an opportunity to lead workforce transformation, ensuring talent strategies align with AI- and automation-driven changes. Boards will expect clear plans for reskilling, redeployment, and governance of AI in hiring, performance management, and employee surveillance. AI-driven decision-making will also require stronger governance around ethical AI use in hiring, performance management, and employee surveillance, expanding the CHRO’s role in risk and audit discussions. “HR leaders need to be at the table when AI policies are being developed. This isn’t just a technology issue; it’s a people issue, a governance issue, and a reputational risk issue,” one board member emphasized. European labor laws may limit AI-driven job reductions more than in the US, where restructuring is more flexible.

- Political, legal and regulatory uncertainty: Shifting US federal government policies on diversity and inclusion; environmental, social & governance issues; and labor, along with escalating uncertainty concerning EU regulations and mandates as well as global geopolitical and macroeconomic risks, may further elevate the CHRO’s role in corporate governance. Boards increasingly rely on CHROs to interpret policy changes, balance compliance with corporate commitments, and manage reputational risks. “Rising workforcerelated litigation risks will also necessitate closer coordination between CHROs, CLOs, and board-level risk committees,” one chair noted.

Conclusion

The role of the CHRO is increasingly embedded in the broader architecture of corporate governance and enterprise strategy. As business challenges intensify, CHROs who can simultaneously navigate board governance dynamics and internal executive relationships will be critical in positioning human capital as a central pillar of enterprise value and oversight. CHROs who demonstrate commercial acumen, fluency in governance, and cross-functional leadership will not only influence boardroom decisions but also shape their organization’s ability to adapt, compete, and lead in an increasingly complex environment.

This article is based on corporate disclosure data from The Conference Board Benchmarking platform, powered by ESGAUGE.

Distribution channels: Education

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release