Stewardship in AQTION: How the World’s Largest Investors Handle Their Assets

AQTION, leveraging its proprietary database powered by SquareWell Partners, published its second review on how the world’s largest 65 investors (hereafter referred to as the “Top 65”) are evaluating governance and sustainability issues and stewarding their portfolios. Together these investors (including some of the largest Assets Managers, Sovereign Wealth Funds, and Pension Funds) have nearly USD 91 trillion in Assets Under Management (AUM). See a summary post of the findings from last year’s study.

In this year’s analysis of the Top 65, the composition of the universe remains almost identical with the previous year, with only one change: Voya Investment Management (Asset Manager, US) replacing Baillie Gifford (Asset Manager, UK). To maintain comparability, the study retained the same factors used in the previous year’s assessment, while also incorporating new factors designed to capture investor sentiment on emerging topics of interest, such as artificial intelligence.

Notably, this year’s analysis looked athow these influential investors voted on high-profile situations. This includes, for example, the 2024 board contest at Walt Disney and the controversial approval of Elon Musk’s multi-billion dollar pay package at Tesla. These real-world examples offer valuable context to understand how the Top 65 investors are exercising their influence on critical corporate governance matters.

The full report is available here. Below, we highlight some of the key takeaways from AQTION’s review of the stewardship activities of the Top 65 investors, with selected points explored in greater depth.

i. Stewardship Teams

Implementation of structures necessary for stewardship activities – such as the introduction of a stewardship team, or publication of a voting policy – are mature in their development.

Regulatory turbulence, especially SEC’s revised guidance for a more stringent approach to monitoring investor activities that could influence corporate control, may lead investors to carefully evaluate their engagement strategies with portfolio companies and be less transparent in engagements, leaving companies to rely more heavily on their public positions and voting behavior to understand their position.

ii. Pass-Through Voting

As Pass-Through Voting proliferates among index investors, such as BlackRock and Vanguard, active managers remain reluctant to adopt, indicating that voting is more strongly regarded as necessary for active fund management.

iii. Voting Guidelines

Only 18 investors have published one or several regional policies, indicating that stewardship is generally configured to apply global principles. Notably, State Street Global Advisors consolidated several policies into one global position in 2024.

Investors’ voting guidelines published in 2025 have also generally become less prescriptive and more principles-based compared to previous iterations. Notably, several investors have scaled back their focus on Diversity, Equity & Inclusion (DEI) issues in response to recent political backlash, particularly in the U.S. However, no similar shift has been observed regarding climate-related expectations, which remain an important issue for investors.

iv. Proxy Advisors

Proxy Advisors continue to be influential on investor vote decision making, but are not commonly relied on heavily. ISS continues to be the clear leader in supplying research, however, Schroders switched to Glass Lewis as their primary proxy advisor in the year.

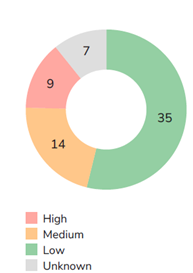

While many investors seek recommendations from Proxy Advisors, most of the Top 65 investors have developed their own internal voting guidelines. To this end, AQTION notes that only 9 of these investors exhibit a “High” reliance on their chosen Proxy Advisor’s recommendations, whereas 35 investors show a “Low” reliance (see Graph 1). As highlighted by ISS’s latest Best Practices Principle Statement, approximately 91% of the total voted shares processed by ISS on behalf of their clients are linked to clients’ custom voting policies. This means that rather than relying on ISS’s standard research recommendations, investors have ISS apply their own voting guidelines when determining how to vote at general meetings.

Graph 1 – Investors’ Reliance on Proxy Advisor Recommendations

v. Stewardship Transparency – Votes and Rationales

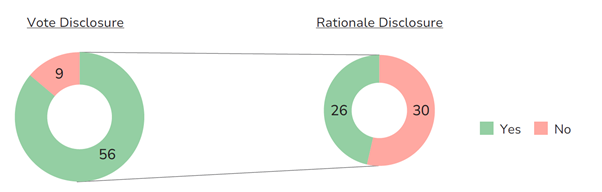

Investor Voting Behavior and Rationale: 56 of the Top 65 investors disclose their voting records, with close to half providing vote rationales (see Graph 2). A few, such as CalPERS and Norges Bank Investment Management (“NBIM”), go further by pre-declaring their voting intentions, while others like Legal & General Investment Management (“LGIM”) and Neuberger Berman do so only for high-profile or contentious votes.

Graph 2 – Investors’ Vote and Rationale Disclosure Practices

vi. Investor Communication on Key Topics

Despite ongoing pushback against elements of the ESG ecosystem in 2024—including the withdrawal of several prominent investors from Climate Action 100+ and the suspension of the Net Zero Asset Managers Initiative in January 2025, investors continue to communicate their expectations on a broad spectrum of topics ranging from executive pay to biodiversity.

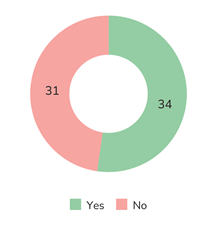

vi.a. One-Off Awards

Investors generally have reservations about awards granted outside of the standard pay package (“One-Off Awards”), considering these awards often reward executives for actions widely considered to be within the scope of their responsibilities. AQTION finds that 34 out of the Top 65 investors provide insight into this topic (see Graph 3). While 8 investors, such as J.P. Morgan Asset Management (“JPMAM”) and Aberdeen Investments are against one-off awards as a matter of principle, other investors (26 of the Top 65) may support special awards outside of Remuneration Policy where the company can demonstrate truly exceptional circumstances and/or significant additional value creation.

Graph 3 – Investors That Have Guidelines on One-Off Awards

vi.b. Artificial Intelligence

As Artificial Intelligence (“AI”) rapidly transforms industries and business models, investor scrutiny on its ethical use, governance, and long-term impact has intensified. AQTION finds that 26 of the Top 65 investors have published dedicated position papers on AI, outlining their expectations for how companies should responsibly integrate AI into their operations. These papers emphasis the need for clear governance frameworks, transparency in AI development and deployment, and an understanding of the societal and ethical risks involved. Investors are urging companies to demonstrate accountability, ensure fairness, and safeguard against potential negative consequences as AI becomes a more integral part of business strategies.

vii. Shareholder Activism

Shareholder Activism: Activism is now a core component of voting guidelines, with 39 of the Top 65 investors incorporating criteria for evaluating activism situations. This marks a broader shift toward proactive stewardship, as traditional investors increasingly use public channels—such as press releases and media statements—to hold companies accountable. Notably, 29 investors have recently disclosed concerns about portfolio company performance or governance in case studies and stewardship reports. In 2024 and early 2025, Neuberger Berman exemplified this trend by publishing detailed voting rationales for high-profile activism cases, including Walt Disney (US), Keisei Electric Railway (JP), UGI Corporation (US), and Rio Tinto (UK), as well as for uncontested votes.

viii. Investors’ Voting Scorecard

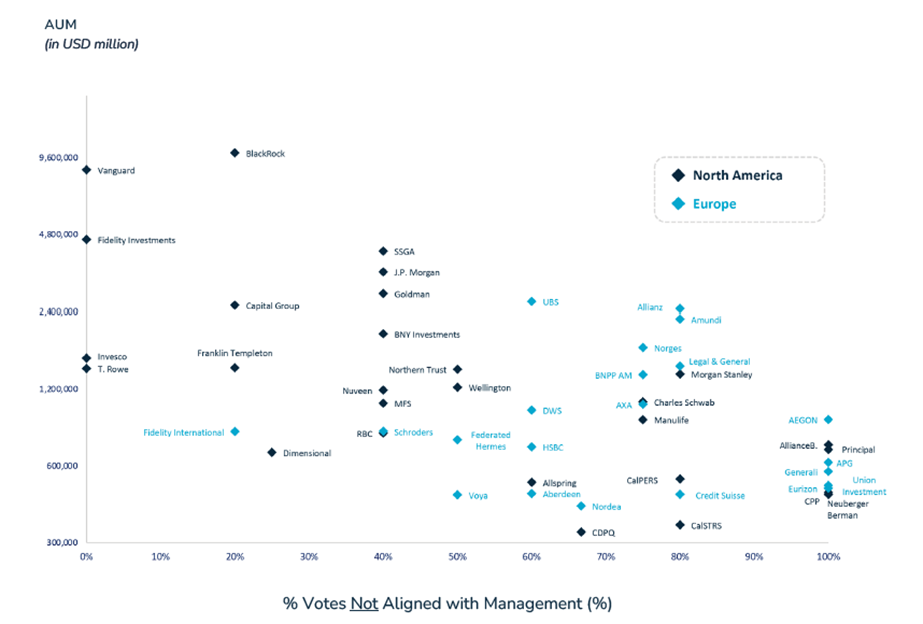

AQTION’s analysis of the Top 65 investors voting behavior suggests that European asset managers appear more comfortable challenging management through their votes, while U.S. investors show a marked hesitance to do so (see Graph 4). This divergence is particularly evident in high-profile cases involving companies such as Boeing, Apple, ExxonMobil, and Walt Disney.

Graph 4 – Investor Voting Patterns in High-Profile Shareholder Meetings

Distribution channels: Education

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release