Refocusing on Fundamentals Amidst Disruption and Divergence

Introduction

Companies are always managing through some level of uncertainty, but the first half of 2025 has introduced multiple, overlapping challenges for compensation committees. Unpredictable effects on supply chains and inflation due to tariffs, cuts and reductions in government spending, and the rapid adoption of artificial intelligence technologies have upended many budgets and, thus, incentive plans. The volatility does not appear likely to abate anytime soon. At the end of the day, neither investors, boards, nor executives seem fully satisfied with the state of executive compensation. As a result, diverging opinions have quietly developed among influential investor groups regarding long-held compensation practices. All of this has created a challenging environment for compensation committees to navigate. But with that challenge also comes opportunity.

Today’s disruptions, divergences, and uncertainties require that companies step back and realign their pay programs with their identity, or “True North.” Leading with identity and culture first will give compensation committees the chance to clarify what they stand for, double down on the metrics that matter, and lead the market with a long-term, principle-based approach to pay.

Finding Your “True North” Creates Clarity Amidst Uncertainty

The companies that best manage open-ended crises are those that stay focused on strategic elements they control, design compensation programs around these elements, and effectively communicate their long-term priorities to stakeholders.

1. Strategy – Re-Focusing on Core Principles

Present uncertainty doesn’t mean that the strengths and skills that helped a company succeed in the past should be abandoned. Organizations should strive to:

· Define who they are: Anchor your pay philosophy in your company’s unique business model, values, and long-term priorities. What areas of strength can be leaned on in tough times, and what areas will need shoring-up to succeed?

· Avoid chasing the crowd. Knee-jerk reactions and changes to strategy rarely go over smoothly with investors and stakeholders.

· Commit to long-termism: Prioritize sustainable value creation, especially when investor signals are fragmented or short-term pressures dominate. Expanding time horizons aligns everyone on a tangible growth path to weather periods of volatility.

2. Design – Using Compensation to Create Alignment

As macroeconomic uncertainty strains pay for performance alignment, now may be the perfect time to re-focus compensation on core principles, centering on:

· Ensuring compensation reflects real contributions: Pay programs should capture the full scope of an executive’s impact—judgment, resilience, and leadership—not just near-term financial outcomes.

· Broadening how performance shows up: Pay-for-performance can take many forms— PSUs, RSUs with tight performance management, or premium-priced options in high-growth contexts.

· Measuring what matters: Use metrics that align with your strategy, even if they fall outside investor convention. If, for example, top-line growth targets become suddenly untenable, there may be another metric that captures success, such as relative margin growth or relative return on invested capital (ROIC).

3. Dialogue – Aligning Stakeholders Toward Long-Term Growth

Committees can use the opportunity presented by investor divergence to broach a more nuanced, strategy-specific conversation around pay. Best practices include:

· Starting early. Shareholders can poorly perceive the appearance of knee-jerk changes to compensation programs. Begin laying out the rationale and definitions of success in advance.

· Tying executive performance to positive shareholder outcomes. A focus on long-term share price growth, underpinned by frameworks for how key financial or operational performance metrics tie into long-term increases in shareholder value, can align all stakeholders when there is little firm ground to stand on.

Three Issues Confronting Compensation Committees, and How to Navigate Them

Once companies establish their guiding principles, we’ve encountered a variety of useful tactics and advice for handling specific, present-day challenges and re-focusing compensation plans around them, no matter how exposed they are to the following issues.

Managing Macroeconomic Effects on Incentive Payouts

Due to an unpredictable macroeconomic environment, short-term incentive payouts based on goals set in early 2025 may no longer accurately reflect the strength of an executive’s operational execution. While it is too early to predict completely, proactive committees are now developing the scenarios, frameworks, and rationale necessary to make possible adjustments to incentive plans at year-end, ensuring they maintain pay-for-performance alignment. We have found that, in the absence of clarity over tariffs, executive actions, and inflation, focusing on the business elements executives can still control offers a valuable True North.

As we’ve previously discussed, one of the first steps is to conduct a self-study of incentive programs that considers: whether executives properly prepared the company for current challenges, the sizing of potential adjustments, whether or not the current plan offers committees flexibility to make changes, and the durability of incentive programs to weather short-term challenges.

From there, committees should discuss what constitutes success going forward, relevant metrics, and what level of performance might merit an adjustment. Where, for example, are the areas executives can actually influence outcomes (such as improving current product/service quality, diversifying sourcing, etc.), and how do they positively impact long-term business outcomes?

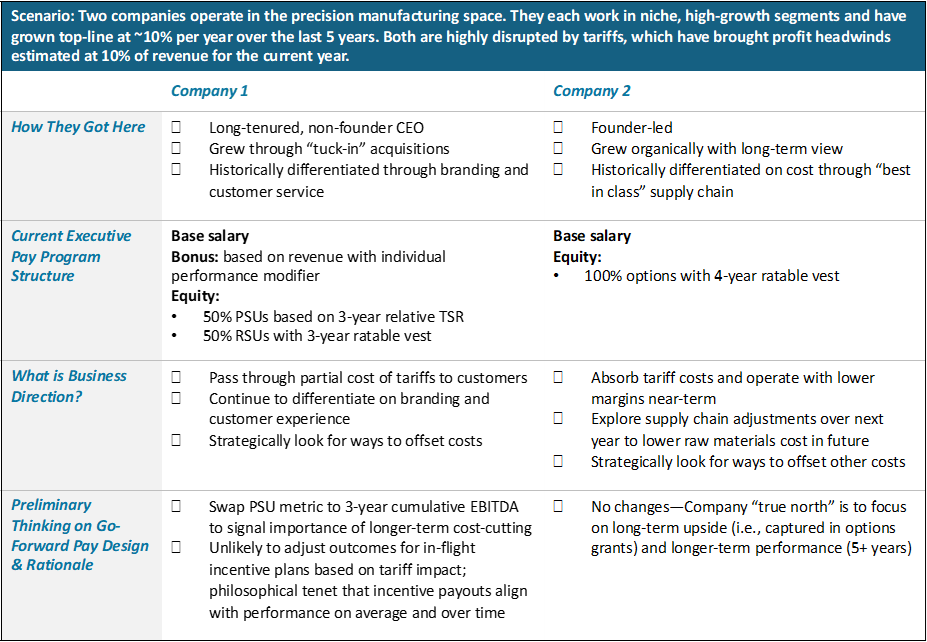

In some cases, lower payouts on incentives may be warranted – a lack of planning or structural agility should not be rewarded. In other cases, committees will rightfully want to reward executives for overperformance, nimbleness, and organizational resilience. Outlining what each of these scenarios looks like and how to respond to them, in advance, is crucial. And overlaying this decision-making framework with an understanding of the company’s culture will help guide committees to the right decision. As seen in the case studies above, even two very similar companies might take radically different approaches, neither of which is “incorrect.”

Investor Divergence on Performance-Based Incentives

As volatility makes longer-term performance share units (PSU) increasingly difficult to forecast and set goals for, a quiet divergence between influential investor groups is unfolding. Some investors want even broader use of performance shares and tighter goal setting; others are openly questioning whether PSUs should remain part of the pay model at all. Companies, and executives, are caught in the middle. Instead of following the crowd, boards would do well to return to core strategic principles, ensuring performance-based incentives are accurately motivating the key priorities identified as the organization’s “True North.”

The recent philosophical divergence surrounding PSUs presents compensation committees with an opportunity to reassess whether such orthodoxy is appropriate for their organization, goals, and culture. The strongest compensation programs are those that best align pay with unique strategic priorities and long-term sustainability, even if they don’t align with common peer practices.

This may require re-designing the structure of current PSUs, with committees making deliberate changes to relevant metrics, experimenting with new goal-setting and measurement approaches, and changing timeframe. The goal of these re-designs is to better focus on long-termism and provide more flexibility for executives to navigate “how to get there,” while still retaining the performance focus/orientation that many investors value.

Though PSUs are not going to disappear overnight, nor should they, we’ve seen more investors and committees start considering adding other vehicles to pay mixes. Some companies are relying on heavier mixes of RSUs or long-dated, time-based shares. Other groups are experimenting with “exotic” vehicles, such as premium-priced options, price-vested options, or options with other exercise restrictions (such as European-style, long-term options).

Increased Attention on Artificial Intelligence (AI) and Workforce Strategies

While AI rarely impacts executive pay directly, its influence on workforce strategies, board composition, and long-term planning is already seeping into compensation committee discussions. AI is quickly becoming a larger facet of corporate governance, and a recent ISS report found that “the percentage of S&P 500 companies disclosing some level of board oversight or AI competency in their proxy statements soared […] more than 150 percent from 2022 to 2024.”

The need to develop strategies for finding and retaining talent at all levels of the organization will only continue to grow, and we’re seeing companies become more tactical about segmenting their AI talent needs, differentiating between the ways it can help their product and the ways it can increase staff efficiency. Companies will need to wrestle with big questions related to their identity: Does their product need top-tier AI-leading engineering talent, or will it be more critical to hire AI-adjacent talent to drive internal efficiency? This does not mean, however, that companies should jump into the AI frenzy in ways that do not support their long-term priorities. If significant investments in AI engineering talent do not make sense for your business, for example, you should not feel pressured to incorporate them into your pay strategies. Boards should ask themselves if there are other, less costly ways to use AI technology to drive the business forward.

As the percentage of directors with AI experience grows (20% of the S&P 500 in 2024, up from 14% the year before), forward-thinking compensation committees can set themselves up for success by implementing continuing education plans, sizing potential changes to the workforce, and appointing AI experts to the committee when necessary. Establishing a vision for the future identity of the company—from the product side to the staff side—is required.

Conclusion

One of the few things companies can be certain of is uncertainty. While the rate of volatility may fluctuate, its presence will never completely disappear. Similarly, while diverging investor group opinions may create uncertainty around shareholder expectations, they also create opportunities to break away from the status quo when it best suits long-term growth. In disruptive times, it is more crucial than ever to hold fast to core principles and long-term perspectives. Refocusing the organization on the elements that made it successful in the past will drive growth, regardless of what the future brings.

Distribution channels: Education

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release